Although there were about 2,000 fewer home buyers in April compared to March 2021, on average they borrowed about $16,000 more, with the average loan size hitting $451,516 compared to $435,234 the previous month.

That's according to the Australian Bureau of Statistics' (ABS) lending indicators data for April, which also shows another record month for owner occupied housing loans.

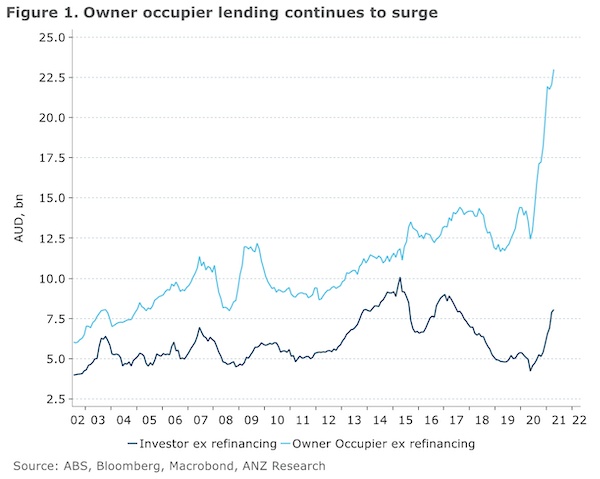

“The value of new loan commitments for owner occupier housing reached another all-time high in April 2021, up 4.3% to $23.0 billion," ABS head of finance and wealth Katherine Keenan said.

"New loan commitments for investors rose 2.1% to $8.1 billion, which was the highest level since mid-2017.

“The rise in owner occupier lending was driven by increased loan commitments for existing dwellings, which rose 9.2%."

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 90% | Featured 4.6 Star Customer Ratings |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% | Featured Apply In Minutes |

| |||||||||

6.09% p.a. | 6.11% p.a. | $2,421 | Principal & Interest | Variable | $0 | $250 | 60% | Featured Unlimited Redraws |

|

Calculations from ANZ's research team show that owner occupied lending is now 55% above the average level of lending over the five years to the pandemic.

"Monthly growth was dominated by the continued recovery in NSW (+8.9% month on month) and Victoria (+8.4%)," they said.

"Both these cities saw lower vacancy rates in April compared to March, and Sydney in particular has a convincing downward trend in vacancies.

"This is a positive sign for investors in those cities, whose borrowing may signal optimism about the continuing momentum of the labour market.

Construction loan growth starting to wane

There was some tapering off in the construction sector, with the ABS putting that down to the end of HomeBuilder.

"Loan commitments to owner occupiers for the construction of new dwellings fell by 11.4%, following a fall of 14.8% in March," Ms Keenan said.

"These were the first monthly declines since the Homebuilder grant was introduced in June 2020. However, the value of construction commitments remained at a high level.”

However, Housing Industry Association economist Angela Lillicrap said with international borders closed, home owners were still diverting their money into housing and renovations.

“Lending for renovations continues to be strong. The value of loans for alterations and additions is up by 66.7% in the three months to April 2021 compared to the same time last year," she said.

“This is the first ABS data to show that we are past the peak in the surge in construction due to HomeBuilder.

“Low interest rates and strong house price growth will continue to support demand for new housing."

Photo by Spencer Chow on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan

Harry O'Sullivan

Harry O'Sullivan