UPDATE: As of June 2023, the Bloom app has closed, after around 15 months in operation.

Bloom essentially puts ethical or green investing into a single easy-to-use app. The platform allows users to invest in a variety of clean energy-labelled ETFs and other ‘green' assets. So, how do you use it, how much does it cost, and where does it invest?

Savings.com.au spoke with Bloom’s co-founder Camille Socquet-Clerc (pictured below right) to find out what sets the Bloom investing app apart.

What is the Bloom investing app?

What does Bloom invest in?

Bloom invests in a varied range of green-labelled exchange traded funds (ETFs), other listed investments, individual companies, and funds.

-

53 International Listed companies

-

5 ETFs: 3 equity + 1 bond + 1 carbon ETFs:

-

iShares Global Clean Energy ETF 79 Holdings

-

BetaShares Climate Change Innovation ETF 99 Holdings

-

VanEck Global Clean Energy ETF 30 Holdings

-

KraneShares Global Carbon Strategy ETF*

-

BetaShares Sustainability Leaders Diversified Bond ETF - Currency Hedged

-

-

24 Australian Listed Companies

-

1 Infrastructure Impact Fund

-

9 Green and sustainable bonds

-

3 Fixed Income and alternatives

Bloom fees and charges

Bloom’s fees consist of a $4.50 per month fee and a 0.80% p.a. management fee for balances under $10,000. For account balances over $10,000, the monthly fee is waived. For a $500 account balance that works out to be $58 per year ($54 plus $4 management fee).

This is to invest in 95 assets including five ETFs as listed above, and for an unlimited number of trades with auto-investing also available.

While the management fees look high, Ms Socquet-Clerc highlighted why Bloom provides bang for buck.

“Just to buy our Australian shares and five ETFs, would cost hundreds of dollars with the cheapest brokerage platforms,” she said.

Ms Socquet-Clerc referenced the $5-$20 brokerage fees and annual management fees associated with investing in ETFs.

“We are slightly more expensive because of the asset classes we offer and because we do active impact investing - with a thorough impact screening process - not just passive investment in ETFs,” she said.

“Bloom is slightly more expensive than other micro-investing platforms but cheaper than all impact investing funds in Australia. As soon as we reach a certain scale we will be lowering this pricing.”

Bloom performance

Ms Socquet-Clerc said just because the fund is focused on green investments doesn’t mean it’s light on potential performance.

“Investing in ‘cleantech’ has a real potential to outperform the ASX200,” she said.

“Bloom is for people who want to get competitive returns, not just impact. The backtesting of our portfolio resulted in a 24% return in the year to December 2021.”

“We have been inspired by the Deloitte Cleantech Index, which has outperformed the ASX 200 for six years in a row. The Index has returned a 39.7% five-year growth versus the ASX200’s 13% [to the end of 2021].”

Of course, past performance is not an indicator of future performance. It should also be reiterated that the majority of Bloom’s investments are targeted at ‘growth’ assets meaning there is a higher risk associated with these assets.

Bloom app sign-up and funding

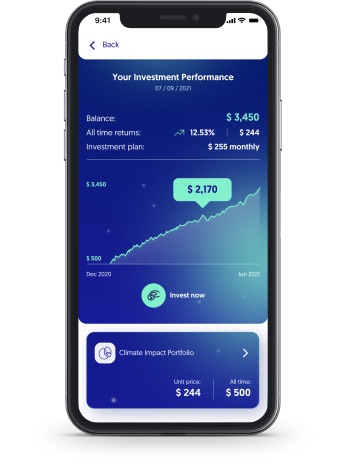

Like many other investment apps, the user experience is quite positive. The app is available on Apple iOS and the Google Play Store. Sign-up is easy and involves some identification steps. From there Bloom highlights what the fund invests in and its fees. Deposits are made via linking a bank account (BSB and account number for direct debits).

Is Bloom safe?

Like other investment apps, funding the portfolio is done through linking a bank account and deposits are made via direct debit.

In terms of investments, it should be emphasised that Bloom is not like a savings account or term deposit. This means it’s not backed by the Government’s $250,000 deposit guarantee.

You are also dealing with shares, which are inherently riskier than a savings account product. Bloom has 70% of its portfolio as growth assets, meaning it is on the riskier end of the spectrum. However risk is mitigated somewhat by investing in a wide array of companies and ETFs.

The company recommends investors should start with a minimum timeline of seven years.

As you are essentially giving money to Bloom to invest for you, you will not receive CHESS-sponsorship notification like you would if you purchased shares directly through a broker. CHESS sponsorship essentially means there is a paper trail of you owning the shares.

Ms Socquet-Clerc says Bloom has some experienced hands at its helm.

“Dan East is our investment manager with 35-plus years' experience in ethical investing, and is ex-Chief Investment Officer at Future Super,” she said.

What type of investor does Bloom suit?

Ms Socquet-Clerc said Bloom has the potential to suit a wide range of investors.

“Bloom helps people easily invest for the long term, in a diversified growth portfolio. It’s perfect for people who don’t have hours to conduct research on each individual investment, both from a financial and impact perspective,” she told Savings.com.au.

“With our auto-invest feature, Bloom is also for individuals who wish to put their investments on auto-pilot to benefit from dollar-cost averaging.”

Younger investors

“Bloom being a growth product - 70% growth assets, 30% defensive - it is typically ideal for young investors looking to build their wealth over time. Ideally, we recommend investing for seven years,” Ms Socquet-Clerc said.

SMSFs and trusts

Bloom is self-managed super fund and trust compliant, with minimum investments starting at $5,000.

“[This] can be a tax-effective way to invest - or sometimes the vehicle is used by families for their kids,” Ms Socquet-Clerc said.

“It’s perfect for customers who tried to get access to impact investing but did not qualify as wholesale or sophisticated investors and don’t necessarily want to go through an advisor.”

See Also: How and what to invest in an SMSF

Advertisement

Looking to take control of your retirement? This table below features SMSF loans with some of the most competitive interest rates on the market.

Lender | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | More details | ||||||||||||

| FEATURED | loans.com.au – SMSF 70

| ||||||||||||

loans.com.au – SMSF 70

| |||||||||||||

| Variable | More details | ||||||||||||

Firstmac – SMSF 70 (Refinance Special) | |||||||||||||

| Variable | More details | ||||||||||||

Liberty Financial – Liberty Residential SMSF (LVR < 80%) | |||||||||||||

| Variable | More details | ||||||||||||

Yard – SMSF Loan (Principal and Interest) (LVR < 80%) | |||||||||||||

| Variable | More details | ||||||||||||

La Trobe Financial – SMSF Residential | |||||||||||||

| Variable | More details | ||||||||||||

| FEATURED | loans.com.au – SMSF 80

| ||||||||||||

loans.com.au – SMSF 80

| |||||||||||||

- Available for Purchase and Refinance. No application fee and no settlement fee

- No monthly, annual or ongoing fees

- Access your SMSF loan via our easy-to-use online app Smart Money

How does Bloom ensure the assets are truly ‘green’?

‘Greenwashing' refers to companies claiming their investments are green for consumer appeal - due diligence usually reveals they aren’t making any real sustainability efforts.

Bloom features positive screening to align investment with scientific climate solutions, which is reviewed by an expert investment committee.

Ms Socquet-Clerc said Bloom does “science-based” investing, not just investing based on a theme.

“This is a big issue we're passionate about … We use two of the most robust climate science models —Project Drawdown and ClimateWorks to define our investment universe or what we invest in,” she said.

“Project Drawdown has modelled how society can transform to a better climate future today. It outlines 82 climate solutions and practices that can halt the production of greenhouse gases in our atmosphere by 2050.

“These independent knowledge pillars guide our positive climate impact modelling in-house. Bloom isn’t inventing benchmarks of its own. It’s following and supporting valid climate science.

“We are working on our measurement model and will be making our impact even more transparent in the future.”

What sets Bloom apart from other apps and investing options?

Bloom purports to have a few benefits over other investing apps and green asset investment options.

Actively managed

Bloom’s investment direction is actively managed by Dan East, who has 35 years' experience in ethical investing with previous experience as Chief Investment Officer at Future Super.

This is opposed to ETFs, which are usually passively managed. Active investment can be seen as beneficial as investment managers aim to beat the market. While passive investing can be lower-cost, active investing holds appeal for those wanting a more hands-on approach from a company that trades more frequently.

Wide range of assets and ‘hard to find’ options

It’s hard as an everyday investor to think about how to invest in say, solar panels. This is where Bloom levels the playing field.

“At Bloom, one of our key goals was to offer access to unlisted assets that are normally hard for retail investors to access such as solar energy projects, clean energy debt, and green bonds,” Ms Socquet-Clerc said.

“When you invest in Bloom, you invest in clean energy projects such as commercial solar projects or energy storage batteries located in Australia.”

Bloom invests in everything from storage, insulation, recycling, electric cars, batteries, waste management, sustainable agriculture, telepresence, dynamic glass, and green hydrogen.

Genuine green exposure

Only four ETFs passed Bloom’s impact screening process: Betashares' ‘ERTH’; VanEck ‘CLNE’, iShares' ‘ICLN’, and KraneShares' ‘KRBN’.

“ETFs only invest in listed stocks - companies publicly listed on various stock markets. Bloom gives you access to unlisted impact assets - fixed income, alternatives, and infrastructure,” Ms Socquet-Clerc said.

“[These] truly make a positive impact … we like to say Bloom is an Extremely well-Thought-out Fund.”

Democratises impact investing

Impact investing refers to investing with the aim to generate returns while also creating positive social or environmental impacts.

Ms Socquet-Clerc said a lot of impact investing is reserved for the wealthy.

“Most impact investing funds in Australia require to be a sophisticated or wholesale investor. Some funds accept individual investors but have a high minimum,” she said.

“A sophisticated investor is a person with a certificate from a qualified accountant certifying they have a prescribed net asset of at least $2.5 million or gross income level of $250,000. This gives them an exemption under the Corporations Act 2001.”

Such impact investments in question include: Australian Ethical High Conviction Fund’s minimum investment of $25,000; Palisade Real Assets Fund, $50,000, and Melior Investments, $50,000.

Other investment options - Bloom compared

Bloom sits a crossroads, being an investment app but not quite a ‘micro investing’ app. It also allows users to invest in a wide variety of ETFs and other investments - to do this through a broker could cost hundreds. In this sense Bloom is hard to compare directly, but here are a few other alternatives.

Apps and micro-investing

-

Raiz: Starts at $3.50 per month or $4.50 for a custom portfolio for ‘microinvestments’ starting with spare change.

-

Spaceship: $2.50 per month with a variety of portfolios on offer, start with as little as $1.

-

CommSec Pocket: $2 brokerage fee and a $50 minimum investment.

-

Blossom: Invest in bonds and defensive assets, a targeted 3% p.a. return, with a 1% p.a. management fee charged once customers receive their return.

Brokers

-

Pearler: $9.50 per trade. 24 shares and five ETFs would cost $275.50 per year plus management fees of each ETF, and a minimum investment of $500 is usually required for ETFs.

-

SelfWealth: $9.50 per trade. Cost similar to Pearler.

-

SuperHero: $5 per trade. 24 shares and five ETFs would cost $125 per year, plus ETF management fees.

Bloom investing app pros and cons

Essentially a recap of what was covered above, here is a breakdown of the benefits and drawbacks of the Bloom investment app.

Pros

-

Low barrier to entry: A $100 minimum investment is lower than many other investment options requiring thousands of dollars.

-

Invest in a wide range of assets: Bloom invests in 95 investment choices including five green ETFs.

-

Suits those with a growth mindset: 70% of assets target growth, suiting someone younger with more time in the market or those with more appetite for risk/reward.

-

Green investing: Bloom has a thorough screening process to ensure the assets it invests in are truly green, minimising the advent of ‘greenwashing’.

Cons

-

More expensive than other apps: At $4.50 per month and a 0.80% management fee, this is more expensive than other apps such as Spaceship and Raiz. That said, Bloom is actively managed as opposed to being passively managed, and the fee is waived for balances over $10,000.

-

Growth = risk: Relatively few of Bloom’s investments are considered defensive, which may not suit an older investor or someone looking for more stable investments.

-

Minimum investment of $100: While low compared to other impact investments, other apps such as Raiz allow you to invest starting with pocket change.

-

Not a savings account: This probably goes without saying, but it’s not a savings account or term deposit product backed by the Government’s deposit guarantee. This means if you lose money, you’re likely on your own.

- Green or ethical is subjective: Bloom's interpretation of green or ethical may be different to yours. What one person considers green, another person may not e.g. nuclear energy.

All images supplied.

Rachel Horan

Rachel Horan

Jacob Cocciolone

Jacob Cocciolone

Brooke Cooper

Brooke Cooper