This comes as CommBank iQ’s latest Cost of Living Report across a dataset of 7 million Aussies revealed annual spending to the March 2023 quarter increased 3.4% for those under 35, compared to an increase of 7.7% for those over 35.

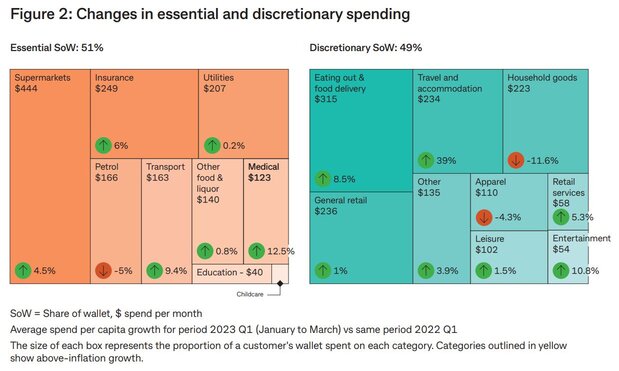

The boost in spending was driven not only by inflation, but an elevation in discretionary purchases, with Aussies cutting corners across spending on everyday items to prioritise experiences.

Millennials aged under 35 are cutting spending the most when compared to those over 35, decreasing discretionary spending in the March quarter across apparel by -8.4%, retail services by -0.6% but increasing spending on eating out by 7.1% .

In contrast, those aged over 35 have spent an additional 3.1% on apparel, 9.7% on retail services and 18% on eating out.

Source: CommBank iQ Cost of Living Report

CommBank iQ Head of Innovation and Analytics Wade Tubman said putting our expenditure under the microscope shows we’re responding to the increased cost of living in diverse and sometimes unexpected ways.

“What we’re seeing is a continued COVID rebound effect, with consumers catching up on the experiences that they missed out on during the pandemic,” Mr Tubman said.

“It seems counter-intuitive that at a time of increased cost of living pressures, consumers are choosing to boost their discretionary spending.”

Source: CommBank iQ Cost of Living Report

Aussies aged 30-34 feel the greatest pinch

The report revealed while most age groups have experienced cost of living pressure, Aussies aged 30 to 34 are experiencing the greatest pain, generating the highest cost of living pressure score.

Mr Tubman noted the cost of living pressure score has started to rapidly pick up since Christmas and the trends are that financial pressure will continue to rise.

"The Reserve Bank's decision to increase the cash rate by 0.25% to 3.85% on 2 May will add to these pressures," he said.

"Looking ahead, the lagged effect of higher interest rates and mortgage costs is expected to further increase cost of living pressures and soften consumer demand."

Renters are also feeling significant pressure when compared to homeowners, consistent with age demographic and life stage analysis.

"While we know recent interest rate increases will be placing a lot of pressure on some mortgage holders, our view of homeowners picks up all homeowners," Mr Tubman said.

"Half of all homeowners are mortgage-free and a third of those with a mortgage have savings buffers of two years or more."

Source: CommBank iQ Cost of Living Report

Melbourne, Sydney residents experiencing greatest cost of living pressure

Across the nation, the report revealed Greater Melbourne as a whole has experienced the greatest cost of living pressures from June 2022 to March 2023.

In Melbourne, CommBank iQ revealed the inner ring and outer areas such as Werribee, Melton and Cranborne are leading the charge in terms of areas experiencing the highest levels of cost of living pressures.

Melbourne aside, CommBank iQ noted Sydney's inner city, east and south west are under increased financial pressure.

"The concentration of younger people and renters in the inner city and eastern suburbs is fuelling the cost of living pressures in those areas," Mr Tubman said.

"In the nine months from June 2022 to March 2023, more Sydney postcodes are showing higher cost of living scores."

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

Image by wirestock via freepik

Rachel Horan

Rachel Horan

Harrison Astbury

Harrison Astbury

Emma Duffy

Emma Duffy