The cash rate has remained at 4.10% since June, with the majority of experts predicting it will be held steady once more when the RBA board meets on Tuesday.

But that hasn’t stopped home loan lenders making interest rate moves, with big bank NAB joining in on the action.

Interestingly, it’s the only bank in the quartet expecting the cash rate to increase one more time, pencilling in the November meeting as the central bank’s most likely call to action.

NAB ups fixed interest rates by up to 15 basis points

For the third time in a month, NAB has featured in Savings.com.au’s home loan round up, this time upping rates on many of its fixed rate products.

Eagle-eyed market participants might remember the bank increased the discounted rate offered to new eligible customers signing on to its base variable rate mortgage in late August. Then, in mid-September, it dropped interest rates across many of its home loan offerings by as much as 96 basis points.

Now, the bank appears to have changed its mind, increasing fixed rates offered on its ‘tailored’ mortgage products, including these:

- Tailored Fixed principal and interest (P&I) 2 years 70%-80% LVR and 80%-90% loan-to-value ratio (LVR): 15 basis point decrease to 6.39% per annum (p.a.)(7.37% p.a. comparison rate*)

- Tailored Fixed P&I 4 years ≤60% LVR and 60%-70% LVR: 10 basis point increase to 6.69% p.a. (7.17% p.a. comparison rate*)

- Tailored Fixed P&I 2 years ≤60% LVR and 60%-70% LVR: 15 basis point increase to 6.34% p.a. (7.20% p.a. comparison rate*)

- Investment Tailored Fixed P&I 3 years 70%-80% LVR: 5 basis point increase to 6.54% p.a. (7.73% p.a. comparison rate*)

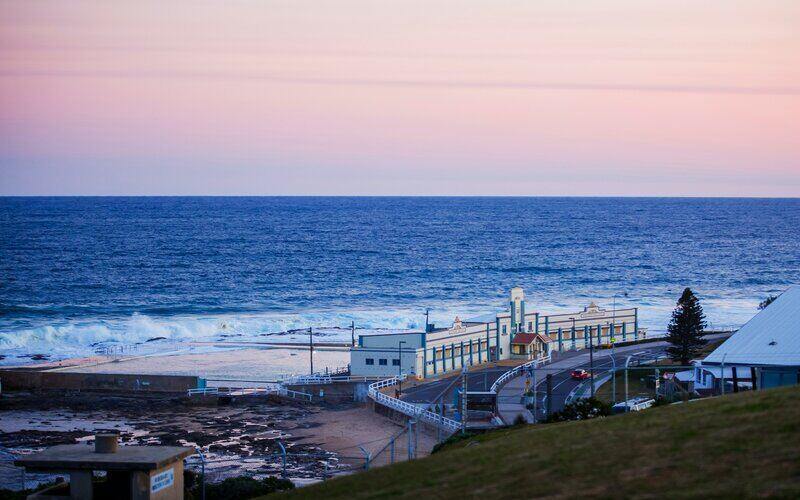

Newcastle Permanent posts special offer, slashes rates on other home loans

In more positive news, a load of mutual banks dropped home loan interest rates this week, with Newcastle Permanent posting the most significant change for the second time this month. The bank’s latest special offer comes at a 58 basis point discount:

- Real Deal interest only (IO) Special Offer ≤80% $150k+: 58 basis point decrease to 5.89% p.a. (5.90% p.a. comparison rate*)

Other changes to the home loan interest rates on offer by the bank include:

- Premium Plus Package Residential Fixed P&I 4 years ≤95% LVR $5k+: 20 basis point decrease to 6.09% p.a. (7.33% p.a. comparison rate*)

- Premium Plus Package Residential Fixed P&I 2 years ≤95% LVR $5k+: 15 basis point decrease to 5.89% p.a. (7.54% p.a. comparison rate*)

- Investment Fixed P&I 2 years ≤95% LVR: 15 basis point decrease to 6.09% p.a. (8.10% p.a. comparison rate*)

- Premium Plus Package Investment Fixed P&I 4 years ≤95% LVR $5k+: 20 basis point decrease to 6.19% p.a. (7.57% p.a. comparison rate*)

Other mutual and challenger banks join the rate cutting action

Newcastle Permanent was far from alone in slashing home loan interest rates this week, with many of its customer-owned peers also taking part.

Greater Bank, which merged with Newcastle Permanent earlier this year, also cut rates by as much as 20 basis points, with highlights including:

- Ultimate Fixed 2 years ≤95% LVR $150k+: 15 basis point decrease to 5.79% p.a. (7.43% p.a. comparison rate*)

- Great Rate Fixed 4 years ≤95% LVR $150k+: 20 basis point decrease to 5.99% p.a. (7.02% p.a. comparison rate*)

Meanwhile, Credit Union SA shook things up with changes such as:

- Fixed Home Loan Package P&I 2 years ≤97% LVR $150k+: 20 basis point decrease to 6.19% p.a. (6.48% p.a. comparison rate*)

- Investment Fixed Home Loan Package P&I 3 years ≤97% LVR $150k: 20 basis point decrease to 6.24% p.a. (6.68% p.a. comparison rate*)

If fixed rates aren’t your thing, challenger Auswide Bank has dropped rates on many of its variable home loan products, with moves including:

- Freedom Package Variable P&I 80%-90% LVR $100k+: 20 basis point decrease to 6.29% p.a. (6.63% p.a. comparison rate*)

- Basic Home Loan PI 80%-90% LVR $50k+: 20 basis point decrease to 6.24% p.a. (6.26% p.a. comparison rate*)

loans.com.au ups variable rates on solar home loans by as much as 60 basis points

Finally, loans.com.au has entered the chat, upping variable interest rates on some of its solar home loans this week.

The lender offers a period of discounted interest rates on loans funding the purchase or refinancing of homes with solar power systems.

As of this week, some those discounted rates – available for the first five years of a home loan – stand at:

- Solar Home Loan P&I 5 year Intro ≤90% LVR $50k+: 10 basis point increase to 5.74% p.a. (6.26% p.a. comparison rate*)

- Solar Investor Home Loan IO 5 year Intro ≤90% LVR $50k+: 60 basis point increase to 6.24% p.a. (6.42% p.a. comparison rate*)

- Solar Investor Home Loan P&I 5 year Intro ≤90% LVR $50k+: 30 basis point increase to 5.94% p.a. (6.33% p.a. comparison rate*)

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 90% | Featured 4.6 Star Customer Ratings |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% | Featured Apply In Minutes |

| |||||||||

6.09% p.a. | 6.11% p.a. | $2,421 | Principal & Interest | Variable | $0 | $250 | 60% | Featured Unlimited Redraws |

|

Image by wirestock on FreePik.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury