Designed as an ‘earning-and-learning’ money app, Kit targets the evolving digital world as parents struggle to keep up with their kids who are taking advantage of digital devices, online games and using cash less.

This comes as CommBank pulled out of school banking in late 2021.

A Kit-commissioned study revealed 48% of parents avoid discussing money with their children, yet 72% of parents are concerned about the influence of online games on their children’s attitudes towards money.

The research was conducted by YouGov, surveying more than 2,000 Australian parents aged over 18 with a child aged between 8-17.

Further, 49% of parents noted their children have spent their money without their knowledge or permission as digital spending has become easier.

These parents say their kids have spent an average of $179.31 – with 22% notching up bills between $200 and $499.

Speaking to Savings.com.au Yish Koh (pictured below), Managing Director of Kit, said in an age where money is becoming invisible, it is becoming harder and harder to teach kids about money.

"Some of the avoidance of the conversation of talking about money comes from a taboo and often parents don't know where to start," Ms Koh said.

"While school education plays a really important role in financial literacy, the role that parents play is around positive money attitudes and behaviours and that only comes with the conversations and the role modelling that parents have with their kids.

"That's what Kit is all about - it's a tool to help both kids and parents have healthy and stress-free conversations."

Yish Koh, Kit Managing Director. Image Supplied.

How does Kit work?

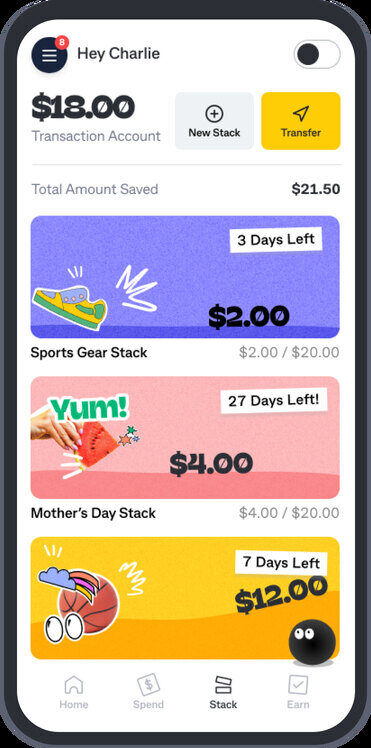

With their own Kit account and prepaid card, kids can earn money on ‘PayDay’ linked to chores being completed. With this money, kids can create customisable savings ‘stacks’ with an animated water level that rises as they reach their goal.

The Kit prepaid card offers similar capabilities as a debit card, meaning kids can access their money through an ATM and tap their card to make purchases.

Apple Pay is also available for kids aged 13 or older, with Google Pay reportedly coming soon.

For parents, the Kit app features a designated 'Boss Mode', meaning greater control through access to customisable features such as spend limits, merchant blocks, card and pin protection. All these individual features can all be tailored to each child in the family.

Kit 'Stacks' feature. Image supplied.

Making money fun

The Kit app features an in-app Kit character designed similar to a video-game hero that teaches kids through nudges, providing teachable moments for kids and parents to connect. For example, if a child removes funds from their savings stack, Kit will provide a prompt or “nudge” to remind them of the impact this will have on them achieving their savings goals.

In September 2023 the app also launched a new feature called Money Quests. Money Quests include mini games and nudges to promote real-world behaviours, like setting up a savings goal.

Ms Koh says given the real gap in the market for a fun and engaging product with real substance in finance education, Kit was first and foremost created for young people.

"On a broader level, we really hope that we can prove Kit substantially and measurably improves the financial capabilities of young people - that's something we are going to continue to iterate our product on," she said.

"At a more granular level, I think for families it would be great to turn around the conversation of kids nagging from an 'I want this, find me that' perspective to 'I've got a bit of pocket money, there's something I would like to buy and I know how I'm going to go and get it'."

Kit eligibility, fees and account limits

Kit is free for up to 30 days and open to customers of any financial institution. After that there are a couple of tiered pricing plans:

- $3 a month or $30 per year for the single child plan

- $5 a month or $50 a year for the multi-child plan (up to 5 kids)

- 12-months free membership for eligible CommBank Yello customers

CommBank Yello is the big bank's new loyalty rewards program offering users cashbacks, discounts, and prize draws.

Kit charges no account, card, transaction or withdrawal fees. It's important to note that ATM operator fees may still apply when withdrawing money.

There are default limits that apply to the Kit card and account, including:

- Maximum account balance $5,000.

- Maximum top up of $1,000 per day.

- Bank transfers $5,000 per day to your linked account only.

- ATM cash out $250 per day.

- Card transactions capped at $999 per day - user can set a spend limit in-app.

How do I download Kit?

More information on Kit can be found at heykit.com.au.

The app is available to download via the Apple App Store or for Androids on Google Play, titled 'Kit - Pocket Money App & Card'.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- A high-interest online savings account with no monthly fees, easy withdrawals and award-winning digital banking

- No withdrawal notice periods or interest rate penalties

- Save up to 10% on eGift cards at over 50 retailers with Macquarie Marketplace

Images supplied by Kit.

Rachel Horan

Rachel Horan

Brooke Cooper

Brooke Cooper

Harrison Astbury

Harrison Astbury