The unsecured personal loan comes with a variable interest rate of 7.5% p.a, which can be repaid weekly, fortnightly or monthly with no early payment penalty.

Compared to home loans for whole properties, which are secured against the property, the personal loan is around five percentage points higher than some of the more competitive variable home loans for owner-occupiers.

While other fractional/fragmented property platforms exist - TicX, BrickX - personal loans for fragmented property investment appear to be a unique offering.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 90% | Featured 4.6 Star Customer Ratings |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% | Featured Apply In Minutes |

| |||||||||

6.09% p.a. | 6.11% p.a. | $2,421 | Principal & Interest | Variable | $0 | $250 | 60% | Featured Unlimited Redraws |

|

Maleny Credit Union chief Sarah Davies said the partnership with Bricklet offers customers a "unique investment opportunity".

"It also extends our ability to offer all-purpose loans to all Australians. It’s not every day a credit union has the opportunity to out-innovate the major banks," she said.

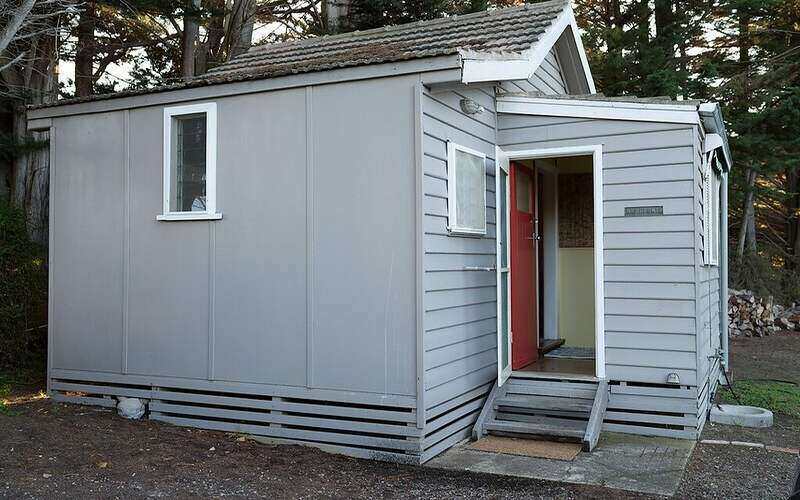

Bricklet chief Darren Younger said it takes the burden out of property investment.

"Property investors now have the opportunity to better diversify their portfolios without the risk of being over-leveraged on entire properties," he said.

"Bricklet removes the complexity of accessing property as an investment."

Mr Younger also told Savings.com.au that investors can live in the properties.

"Having a long-term tenant that also part-owns the property can be beneficial as everyone is invested in the property's future outcome, as well as guaranteeing ongoing rental yield for all parties," he said.

Bricklet is a platform that gives fragmented property investors true ownership of that piece of property, handing over real estate deeds, with the aim of generating passive income through rental yields and capital gains.

Strengths and limitations

While fragmented owners using Bricklet hold true ownership of their part of the property, interest paid on the loan could outweigh capital gains and rental yield.

However, interest costs, along with other costs of the investment, could be claimed as a tax deduction.

A 7.5% interest rate on $25,000 paid off monthly over five years could mean about $5,000 in interest paid, assuming there are no extra fees associated with the loan.

According to SQM Research, housing stock gained 7.0% in value over the past 12 months.

However, past performance is not a reliable indicator of future performance, and this capital gain was only based off houses - apartments have generally performed worse across the capital cities, according to SQM Research, in the same timeframe.

Billie Christofi, of investments group Reventon Finance, told Savings.com.au about some of the other potential limitations of fractional property investments.

"Fractional property investment provides people with a springboard to gain experience and build their funds," she said.

"One thing to be wary of are the fees associated with the organisation you're purchasing through - this, combined with a higher interest rate, can potentially eat into a big chunk of your capital gain."

Property pundits are predicting drops of up to 30% in property prices during COVID-19, while median housing values fell 0.6% in July alone.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Aaron Bell

Aaron Bell