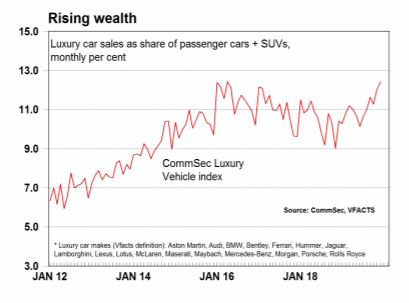

Commsec figures revealed annual sales to December lifted from 87,445 to 88,643, with sales of new luxury vehicles representing a record 12.4% of total passenger car and sports utility sales.

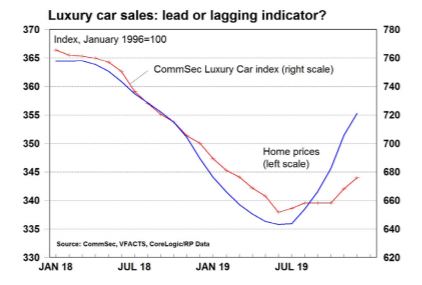

Luxury car sales rose over the same six months, while home prices also rose and household wealth has hit record highs, with these values boosting household asset values and broader wealth, improving the borrowing capacity of budding car buyers.

In the past, movements at the top end of the new vehicle market have led broader vehicles sales.

The same appears to be happening in 2019/20.

Sales of luxury vehicles hit peak levels of 106,658 units in the year to December 2016 and in the year to June 2019.

Rolling annual luxury vehicles sales were down 19.7% on a year earlier, hitting four year lows.

But in July 2019, sales lifted for the first time in two years and the measure has consistently risen since.

Sales are down only 3.5% on a year ago after being down 13.1% in the year to June.

The hope is that the strength at the top end of new vehicle and housing markets will extend to broader strength for new vehicle sales, home sales and home prices.

These positive results can be included in Reserve Bank Governor Philip Lowe's often cited list of "green shoots" in the economy.

However, Commonwealth Bank economists still predict another interest rate cut by the RBA in February.

Looking for a new car loan? Below are some of the lowest fixed rate car loans this month.

Motorcycle sales fail to kick into gear

Motorcycle sales failed to match the strong results posted by luxury car sales.

The Federal Chamber of Automotive Industries (FCAI) revealed motorcycle sales numbers for 2019 numbered 89,199, a 6.1% decrease for the year.

The results come after car sales posted their lowest sales figures since 2011, but the FCAI said while sales are down, market composition remained steady.

Off-road bikes made up 38.5% of the market; road bikes claimed 35.8%, while ATV/SSVs accounted for 20.1%; scooters also increased its share of total sales to 5.6 per cent.

The most popular individual brands were:

- Honda with 20,819 sales (23.3% market share),

- Yamaha with 19,945 sales (22.4% market share),

- Kawasaki with 8,962 sales (10.0% market share),

- KTM with 7,670 sales (8.6% market share), and

- Suzuki with 6,934 sales (7.8% market share).

Road bike sales nationally reduced by 11.9% on the 2018 result, with Harley-Davidson the most popular brand, ahead of Honda and Yamaha.

Scooters continue to be a good news story, with sales for 2019 up 15.9%, accounting for 5.6% of the overall market, up from 4.6% in 2018.

Honda was the leader, followed by Suzuki and Vespa, while BMW, Honda, Suzuki and Yamaha all saw increased sales in this segment.

William Jolly

William Jolly