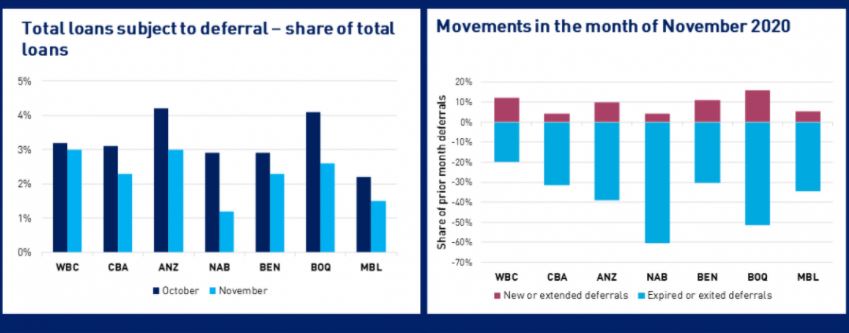

The Australian Prudential Regulation Authority (APRA) found at the end of November, just over $60 billion worth of loans were on temporary repayment deferrals, 2.3% of all loans.

Of those deferred, $49.5 billion were housing loans, making up 2.8% of all housing loans, and $7.6 billion were small and medium-sized enterprise (SME) loans, 2.4% of all SME loans.

This is the first time housing loan deferrals have outpaced SME loan deferrals, but the number of housing loans deferred still outnumber SME loans deferred at nearly four-to-one.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 90% | Featured 4.6 Star Customer Ratings |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% | Featured Apply In Minutes |

| |||||||||

6.09% p.a. | 6.11% p.a. | $2,421 | Principal & Interest | Variable | $0 | $250 | 60% | Featured Unlimited Redraws |

|

The figures are a far cry from the peak seen in late June, where 11% of home loans totalling $195 billion were in deferral.

"Exits from deferral continued to outweigh new entries for the fifth straight month in November, with $32 billion in loans expiring or exiting deferral and $7 billion entering or being extended," APRA said.

Source: APRA

However, Victoria continues to struggle compared to other states and territories, with almost double the proportion of deferred loans compared to the rest of the country.

"Victoria remains the state with the highest proportion of loans subject to deferral amongst the states and territories, with 3.2% of loans deferred compared with the rest of the country at 1.7%," APRA said.

November marked the first time housing loans had a higher incidence of repayment deferral compared to SME loans.

Westpac, ANZ, and Bank of Queensland (BOQ) had the largest share of deferred loans at 3%, and BOQ also had the highest percentage of new or extended deferrals at 16%.

Conversely, NAB recorded a 60% increase in expired or exited deferrals.

Source: APRA

Lenders announced they would extend mortgage deferrals to borrowers still experiencing financial hardship to March, on a case-by-case basis.

With JobKeeper set to end in March, and JobSeeker to return to its pre-pandemic $40 a day in March also, economists and politicians feared the end of the month would bring about a fiscal cliff.

The latest deferral data coincides with better than expected employment figures in recent months.

More to come..

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan

William Jolly

William Jolly