This comes as NAB data revealed goods and services scams have increased 66% over the past three months courtesy of a spike in PayID scams.

PayID is a free payment method utilising a person or business’ mobile number, email address or ABN to send and receive funds instantly.

PayID allows the payer to see a confirmation screen, which includes the payee’s PayID name, before they authorise the payment.

Data from the Australian Competition and Consumer Commission (ACCC) revealed Aussies lost $260,000 to PayID scams in 2022, contributing to the total $3.1 billion lost overall.

NAB Executive Group Investigations and Fraud Chris Sheehan said scammers ramped up their efforts targeting online marketplaces in late 2022 and the problem had continued to grow.

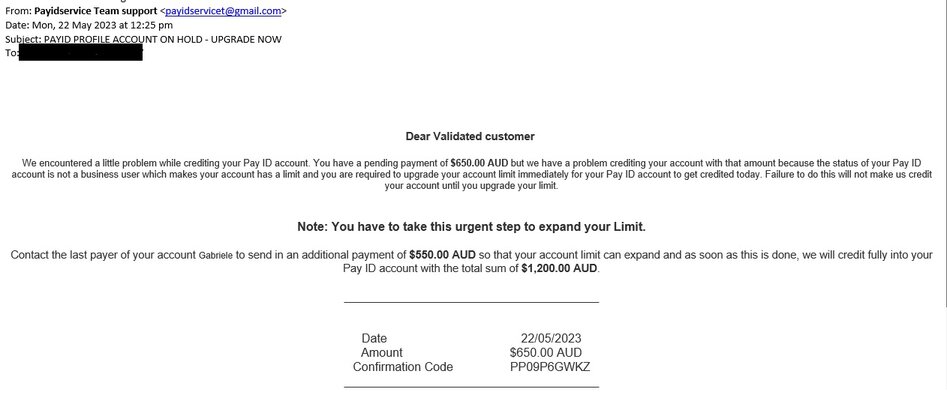

“The buyer often claims the transaction couldn’t be completed because the seller doesn’t have a PayID ‘business account’,” Mr Sheehan said.

“The scammer might say they’ve paid to upgrade the seller’s account and now needs to be reimbursed.”

Source: NAB Example PayID Scam

Mr Sheehan noted the biggest red flag of any PayID related scam is often if someone asks you for money to upgrade an account or to access PayID.

“There are never any charges related to using PayID,” he said.

“It’s also important to remember PayID will never send you an email, text or message directly as your bank registers and manages PayIDs.

“If you get an email, text or message directly from ‘PayID’ it is a scam.”

How to spot a PayID scam

PayID scams are currently targeting people selling items on online marketplaces and second-hand websites.

Importantly, customers must remember PayID is managed by your bank and your bank will never ask you to provide significant details or process a payment via email, text or message.

To spot a PayID scam, some common red flags to look out for include:

- Being asked to send money first to receive a payment via PayID.

- Being told you need to take additional action, including upgrading your PayID account and paying additional fees before you can receive money into your account.

- Receiving communication directly from ‘PayID’ via email, text or messenger.

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

Image by freepik

Rachel Horan

Rachel Horan

William Jolly

William Jolly