This is according to research by progressive think tank The Australia Institute (TIA), which modelled the impacts of the Morrison Government's planned $100 cut to the JobSeeker supplement from January 2021 onwards.

The new JobSeeker rate will be roughly the equivalent of about $50 per day, which is still considered to be below the poverty line.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest non-introductory and introductory interest rates on the market.

- A high-interest online savings account with no monthly fees, easy withdrawals and award-winning digital banking

- No withdrawal notice periods or interest rate penalties

- Save up to 10% on eGift cards at over 50 retailers with Macquarie Marketplace

While the lowered JobSeeker payment will still be higher than the pre-covid Newstart rate, the TIA report said the new rates would have "a devastating impact on low-income families".

“The JobSeeker supplement has been the only thing standing between many recently jobless Australians and poverty,” said Matt Grudnoff, senior economist at The Australia Institute.

“It [the reduction] will result in hundreds of thousands of Australian families being pushed below the poverty line—it means a struggle to put food on the table, to pay rent or service mortgages, and will it will cause acute pressure on people in an already turbulent time."

After the JobSeeker supplement was raised to $550 per fortnight at the height of the pandemic, previous Australian National University (ANU) research found as many as 740,000 people had been temporarily lifted out of the poverty zone, but could be sent straight back if JobSeeker returned to its old rate.

“No other government has ever lifted so many people out of poverty so quickly, than the Morrison Government did with the Coronavirus Supplement," Mr Grudnoff said.

While 190,000 is admittedly a much smaller number than that 740,000 figure, those who advocate for a more permanent increase to the rate say it is still too many.

"The supplement has been an essential part of Australia’s response to this recession and improved the lives of nearly half a million Australians, so it is a disappointing 180° to see the very same government now intent on pushing hundreds of thousands of people back below the poverty line," Mr Grudnoff said.

“Punishing the unemployed during a recession, when there are more than ten unemployed people competing for every one job vacancy, is simply cruel.

"Now is the time to support the unemployed, not punish them for losing their job.”

Prime Minister Scott Morrison however was firm in his intent to incentivise people to take up work.

“We cannot stay stuck in neutral in this country, we have got to keep moving forward,” he said.

See also: Up to 106 Jobseekers for every entry-level job in Australia

He noted that the planned $150 JobSeeker supplement would cost the economy $3.2 billion, while a September report by Deloitte found rolling back the coronavirus supplement would reduce the size of the economy by $31.3 billion and see an average loss of 145,000 jobs over the next two years.

That analysis however was based on the assumption that JobSeeker rate would be returned to the previous $40 per day level.

Queensland to be the worst affected state

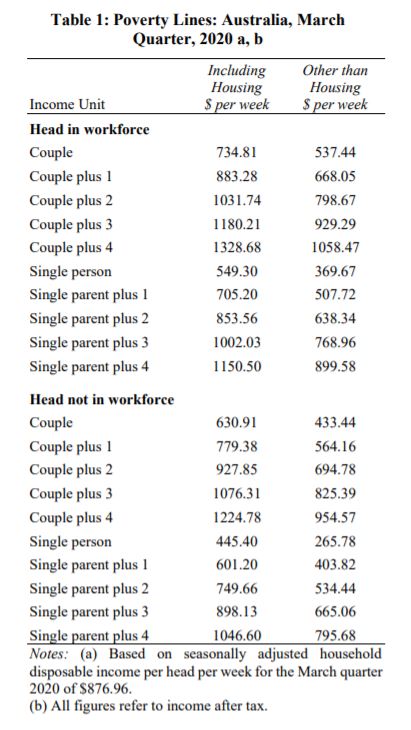

According to TIA's methodology, it doesn't have a single definition for what the poverty line is.

Instead, it calculates poverty rates based on the Melbourne Institute's poverty lines, which analyses the disposable income needed for the average household to support its basic needs.

For example, a single person is considered to be below the poverty line if their household income is below $549.3 per week.

A single parent with four dependants however has a much higher poverty threshold of $1,150 per week, as they would obviously have much greater needs.

Source: Melbourne Institute

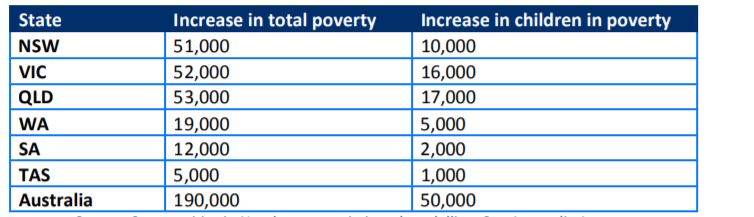

Based on these figures, combined with the 2017-18 ABS Survey of Income and Housing data and the planned cut to JobSeeker, TIA determined that Australia's three most populous states would be the worst hit.

Queensland would suffer the biggest increase in poverty, with 53,000 Queenslanders (including 17,000 children) dropping into poverty.

NSW would see 51,000 people (including 10,000 children) pushed into poverty, while Victoria, the hardest hit state by coronavirus, would have 52,000 extra people in poverty (16,000 children).

Source: TIA

The Australian Council of Social Service CEO Dr Cassandra Goldie said this planned reduction is a "cruel and damaging mistake", and said a $25 per day increase to the old Newstart rate ($65 per day) would help people avoid poverty.

“With this cut, the Government is almost taking us back to the brutal old, Newstart rate. The reduced rate from January to March is only $10 a day more than the old, unlivable Newstart rate, which had not been increased in real terms in more than a quarter of a century," Dr Goldie said.

“The end of the year is often the most expensive time for families and this Christmas is going to be a really hard one for millions, with record-high unemployment.

“At the very least, this needs to be a $25 per day increase on the old, grossly inadequate Newstart rate, which would bring the payment into line with the age pension and above the poverty line."

See also: Top economists back JobSeeker and social housing boosts over tax cuts

Rachel Horan

Rachel Horan

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury