RBA Governor Dr Philip Lowe has reiterated the central bank's commitment to combatting inflation, with interest rates set to rise further.

However, the price of monetary policy tightening and battling inflation is a potential recession, as it takes demand out of the economy.

Speaking at the annual Committee for Economic Development of Australia in Melbourne on Tuesday night, Dr Lowe highlighted the consequences of high inflation in the 1970s and 1980s to demonstrate the need for the RBA to take action.

"High inflation meant lower growth, fewer jobs and lower real wages," Dr Lowe said.

"Another lesson from these decades is that bringing inflation back down again after it becomes ingrained in people's expectations is very costly and almost certainly involves a recession."

He said that given the RBA's remit for price stability and full employment, the cash rate (currently at 2.85%) was expected to continue to rise to lower inflation.

"We understand that many people are finding the rise in interest rates difficult," Dr Lowe said.

"It is necessary, though, to ensure that the current period of higher inflation is only temporary ... if high inflation were to persist, all Australians would pay a heavy price.

"We have not ruled out returning to 50 basis point increases if that is necessary."

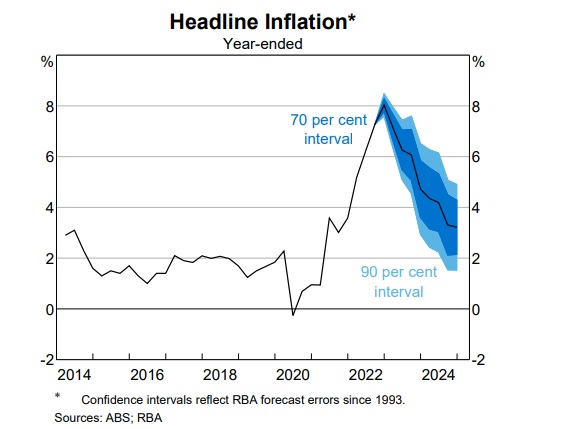

Dr Lowe did say that the RBA's forecast is for inflation to peak later this year at around 8%, before declining gradually to be just over 3% by the end of 2024.

This expectation is based on COVID supply disruptions being resolved, commodity prices stabilising, and global rises in interest rates slowing demand.

However, he warned that several global trends are likely to continue to cause more variability in inflation, such as the impact the increased frequency of extreme weather events has on the supply of goods.

"It is not just food production that is affected by extreme weather. It also disrupts the production of commodities and the transport and logistics industries," Dr Lowe said.

He also said that the global transition towards green energy could result in higher and more volatile energy prices.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 90% | Featured 4.6 Star Customer Ratings |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% | Featured Apply In Minutes |

| |||||||||

6.09% p.a. | 6.11% p.a. | $2,421 | Principal & Interest | Variable | $0 | $250 | 60% | Featured Unlimited Redraws |

|

Photo by Towfiqu barbhuiya on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!