This is despite new car sales experiencing 29 continuous months of sales declines.

Moody's Analytics, which tracks prices on car auction site Pickles' wholesale market transactions, found prices increased 7% in August alone, up from 4.7% in July.

This coincides with Gumtree reporting a 19% surge in used car searches.

Moody's Analytics auto economist Michael Brisson says this is also a global phenomenon.

"The rapid increase in prices for used vehicles due to COVID-19 is not only an Australian phenomenon. It is happening in developed countries across the world," he said.

"The ute segment, which includes SUVs and light trucks, has increased by 32% from the previous year and the wholesale passenger-car market increased by 23% during the same period."

In the market for a new car? The table below features car loans with some of the lowest fixed and variable interest rates on the market.

| Lender | Car Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Interest Type | Vehicle Type | Maximum Vehicle Age | Ongoing Fee | Upfront Fee | Total Repayment | Early Repayment | Instant Approval | Online Application | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.24% p.a. | 7.36% p.a. | $583 | Variable | New | 1 year | $8 | $400 | $35,000 | Featured |

| |||||||

6.34% p.a. | 8.36% p.a. | $585 | Variable | New | 1 year | $8 | $400 | $35,084 | |||||||||

6.57% p.a. | 7.19% p.a. | $588 | Fixed | New | No Max | $0 | $250 | $35,278 | Loan amounts from $2k to $75k |

| |||||||

6.09% p.a. | 7.21% p.a. | $581 | Variable | New | 1 year | $8 | $400 | $34,874 | Featured |

|

Similar interest is seen in the new car sales space, with light commercial vehicles and SUVs making up more than 70% of new sales in August.

However, the used price surge could be short-lived according to Mr Brisson.

"Used-vehicle prices will likely move sideways over the remainder of the year," he said.

"Price gains will slow as supply increases with sellers seeking to take advantage of the high prices and COVID-19-related demand gets wrung out.

"Stress in the labor market will continue to cause consumers to worry about their jobs and the economic recovery.

"This may limit demand in the coming months, lowering prices."

Moody's Analytics' research also reports that public transportation uptake is 60% below January levels, while driving routes searched are down just 10%.

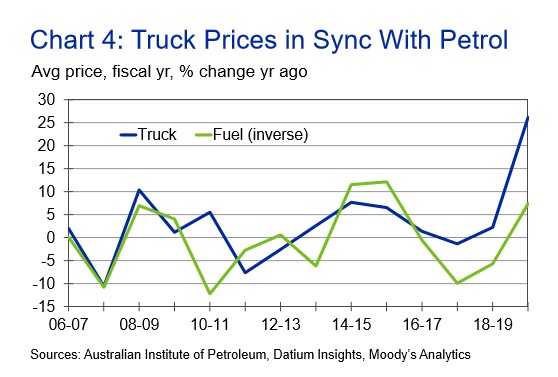

The research also highlighted that as petrol prices decrease (which was seen earlier in the year), demand and prices for used 'trucks' increases (below).

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harrison Astbury

Harrison Astbury