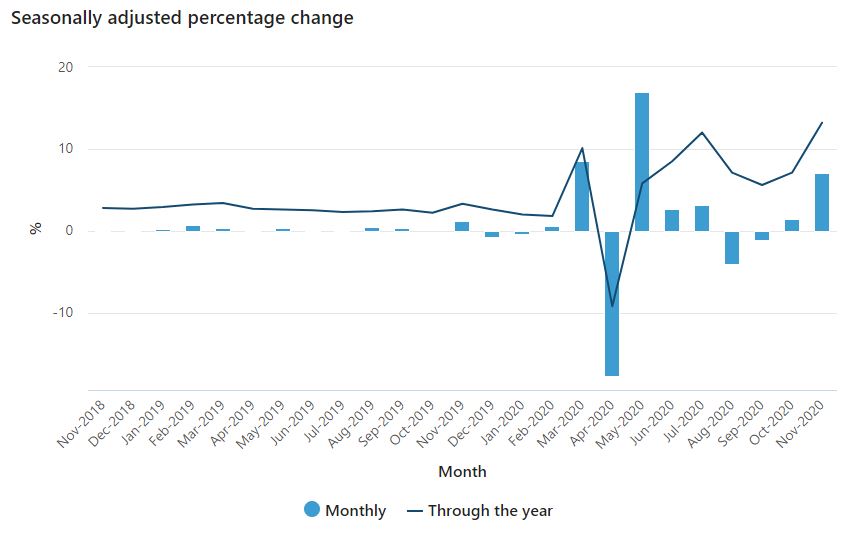

According to figures from the Australian Bureau of Statistics (ABS), the strong spike in sales was well ahead of the median economist estimate of a 2% rise, but forecasts ranged from 0.9% to 7%.

Turnover rose 13.2% when compared to November last year, and ABS Director of Quarterly Economy Wide Surveys Ben James said Victoria was the main driver of the surge.

"Victoria saw a large rise, up 21%, as retail stores experienced a full month of trade following the easing of coronavirus restrictions in that state. Excluding Victoria, retail sales rose 2.7%," Mr James said.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- A high-interest online savings account with no monthly fees, easy withdrawals and award-winning digital banking

- No withdrawal notice periods or interest rate penalties

- Save up to 10% on eGift cards at over 50 retailers with Macquarie Marketplace

Household goods retailing saw the biggest rise in sales (13%), as Black Friday sales coincided with the release of next generation consoles like the PlayStation 5, leading to a spike in turnover nationwide.

The Victorian and Black Friday surges also led to large national monthly rises in clothing, footwear and personal accessories, and department stores.

South Australia saw a flat result after a three-day lockdown saw many retail industries forced to close, although these falls were offset by a rise in supermarket sales.

That may worry those in the New South Wales retail industry, with the state recording eight new COVID cases today, bringing the Northern Beaches total cluster number to 90.

Total retail turnover

Source: ABS

Ecommerce hits record levels in November

Data from eStore Logistics revealed ecommerce and omnichannel retailers handled 46% more customer orders in November 2020 compared to November 2019.

The fulfilment provider shipped over one million items from 500,000 customer orders in November, a new record.

Shoppers in South Australia made the most of Black Friday sales, with 57% more online purchases this November than last, followed closely by New South Wales (55%).

Home and renovation was the top performing category, with 138% more orders this November than last, followed by food, beverages and alcohol (92%), and department stores (92%).

Leigh Williams, Managing Director of eStore Logistics, said while Black Friday was a big factor, there was consistent year-on-year growth in ecommerce.

“Before COVID-19, Australian ecommerce was growing at 20% year-on-year, but the introduction of lockdown restrictions really poured on rocket fuel," Mr Williams said.

"During this time, millions of new customers were introduced to the benefits of ecommerce and while it's natural that some of those have returned to visiting their favourite stores, it's clear that online retail is not going away."

Shoppers urged to pay now, not later

The Financial Rights Legal Centre (FRLC) and Mob Strong Debt Help have urged consumers to avoid using loans or buy now, pay later schemes to purchase Christmas gifts.

Financial Rights Legal Centre Chief Executive Officer Karen Cox said while these options may seem attractive, it could cause families to spiral into debt.

“We often see cases of people who find themselves in difficulty upon realising they cannot meet their loan obligations on top of their living expenses,” Ms Cox said.

“Many people also end up in financial hardship because they take out loans to cover existing repayments.

“It’s important to know that help is available, if you end up in these circumstances.”

Read: One in five consumers missing Afterpay, Zip, and other BNPL payments

Amanda Cameron, Coordinator at FRLC's Mob Strong (which provides specialist help for Indigenous Australians) said there were important steps people could take to avoid getting into debt.

"It’s always best to try to stick to a budget to manage holiday period expenses. If you really need to borrow try to keep the amounts to a minimum to ensure it’s as easy to pay back as possible,” Ms Cameron said.

“If you do use the option of a loan, always budget to make sure you can afford each instalment and ensure that each instalment won’t be deducted from your bank account before you receive your next pay.”

Photo by Artem Beliaikin on Unsplash

Rachel Horan

Rachel Horan

Aaron Bell

Aaron Bell

Harrison Astbury

Harrison Astbury