The buy-now, pay-later (BNPL) provider boasted a record transaction volume of $2.1 billion, up 87% year-on-year, and more than 2.1 million customers, up 62%.

However, Zip lags well behind market leader Afterpay, which has 3.3 million customers in Australia and New Zealand, and has roughly the same amount of customers as humm, the third-largest BNPL provider.

Zip also only has 24,500 merchant partners, compared to Afterpay's 42,800 and humm's 56,700.

Zip managing director and chief executive Larry Diamond said the company's expansion into the US and South Africa had helped fuel growth.

"2020 has been another monumental year for Zip as we delivered a record set of financial results, whilst navigating impacts of COVID and transforming the business with a number of game-changing products and business acquisitions, " Mr Diamond said.

"We began FY20 with a vision to become a global BNPL player and capitalise on the increasing trends fueling the industry's growth.

"The successful acquisition of PartPay led us to QuadPay, all developed on the same code base, with proven portability into multiple global markets."

Source: Zip

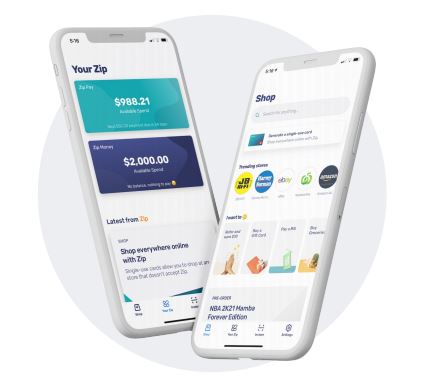

Zip offers two BNPL schemes: Zip Pay, available for purchases under $1,000, and Zip Money, available for purchases over $1,000.

Zip Pay is interest-free, with monthly and/or late fees depending on when the balance is paid off, while Zip Money has the same fees but charges interest after the first three months.

In the past year Zip said it had just 2.24% net bad debts, with only 1% of customers making late payments, in contrast to one-sixth of credit card customers and other BNPLs.

Zip's customer base was predominantly female (60%), with 50% of customers under the age of 35 and 80% of payments made online over instore.

The past financial year saw a number of large retailers join the platform, including Amazon, Cotton On, PetBarn, Grill'd and Pizza Hut.

Its personal finance management app PocketBook also now boasts over 800,000 users and 1.6 billion transactions to date.

The app syncs with your bank account and allows you to categorise transactions, allowing you to see where your money goes and where you can cut back.

Looking forward, Zip said it was looking to launch in the UK and accelerate its growth in the US and continue to support Australian and New Zealand small businesses.

Brooke Cooper

Brooke Cooper

Hanan Dervisevic

Hanan Dervisevic

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly