| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.99% p.a. | 7.00% p.a. | $2,659 | Principal & Interest | Variable | $0 | $230 | 70% | Featured |

| |||||||||

7.24% p.a. | 7.25% p.a. | $2,726 | Principal & Interest | Variable | $0 | $0 | 70% | |||||||||||

7.25% p.a. | 7.65% p.a. | $2,729 | Principal & Interest | Variable | $30 | $1,190 | 80% | |||||||||||

7.55% p.a. | 7.94% p.a. | $2,811 | Principal & Interest | Variable | $395 | $1,920 | 80% | |||||||||||

7.75% p.a. | 7.83% p.a. | $2,866 | Principal & Interest | Variable | $0 | $995 | 80% | |||||||||||

7.49% p.a. | 7.50% p.a. | $2,794 | Principal & Interest | Variable | $0 | $230 | 80% | Featured |

|

What is an SMSF?

To recap before we get into the meat of the fees, an SMSF, or self-managed superannuation fund, is essentially a private super fund you manage yourself, instead of letting a private fund manager do it for you. They can be useful for those who want greater control over where their retirement funds are invested, but can be more complicated and, as we’ll explain in this article, more expensive on average.

Learn more about SMSFS here, including how they work with savings accounts and how to buy a property through an SMSF.

How much do SMSFs usually cost to run?

Overall, SMSFs can be quite expensive to run, and usually require more funds in them to be a worthwhile investment (more on this later). According to the Australian Taxation Office’s (ATO) statistical overview of SMSFs in 2017/18:

- The average total cost of running an SMSF was $14,879; and

- The median total cost of running an SMSF was $7,710

These include a range of deductible and non-deductible different expenses.

Total expenses – average and median

|

Total expenses |

2017–18 |

2016–17 |

2015–16 |

2014–15 |

2013–14 |

|---|---|---|---|---|---|

|

Average |

$14,879 |

$14,166 |

$13,935 |

$12,387 |

$11,301 |

|

Median |

$7,710 |

$7,285 |

$7,100 |

$6,152 |

$5,557 |

Source: ATO

So the median SMSF can cost almost $8,000 per year. These total expenses are higher for funds with greater assets too. The same research by the ATO found the median total expenses for a fund with between $0 and $50,000 was $1,871 per year, while funds over $2 million attracted median fees of $15,814.

It’s worth noting that there is some dispute over whether these fee breakdowns are entirely accurate. An Australian Financial Review analysis in 2019 found these figures could be off by as much as 50% in some cases. Rainmaker Information director of research Alex Dunnin said the average annual cost SMSF’s reported by ASIC seem over the top by a wide margin.

"Putting all this together means ASIC's SMSF cost estimate is wrong by 50%. It’s not nearly $14,000 per SMSF but more likely around $9000,” he said.

Are SMSFs more expensive than normal super funds?

Comparatively, SMSFs are much more expensive than the average super fund. While the average SMSF fund is almost $15,000 per year, a 2019 Rainmaker report on super fees found the average super fund charges $2,400 per year on average - the cost of the average household energy bill. That’s roughly 1/6th of the cost of the average SMSF.

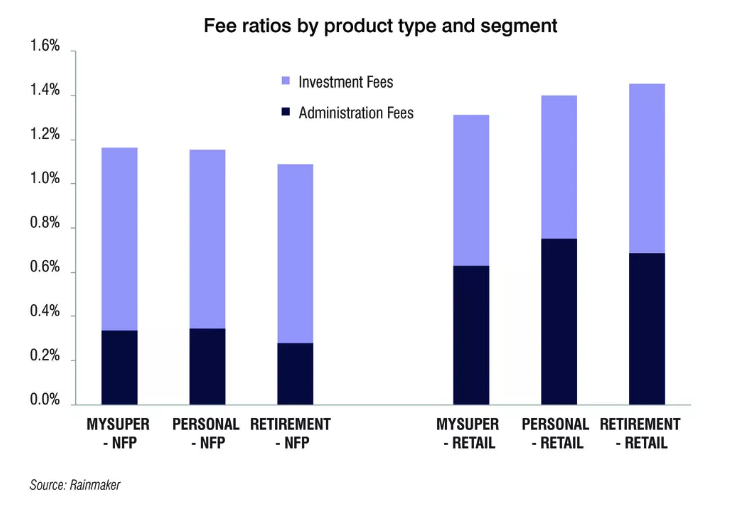

Superfund members in Australia are now paying 1.1% of their total balance in fees on average, actually down from the 1.2% they were paying in 2018. So while SMSFs appear to be getting more expensive, extensive scrutiny and legislation in the superannuation industry has seen fees fall for the average customer.

What are the different SMSF fees?

Those SMSF costs mentioned earlier aren’t just a one-off fee you have to pay. SMSFs are a multi-faceted investment scheme, and like other products contain different types of fees. Generally, the average SMSF will pay the following fees:

- Establishment/upfront costs

- Ongoing/operating costs

- Investment management costs

Generally speaking, a ‘good investment’ should not have fees too far in excess of 1% of the total balance. If possible, aim for less than 1%.

SMSF establishment/upfront costs

The establishment costs, or upfront costs, are the costs you need to pay to set up an SMSF in the first place, in a similar way to how you’d often pay an establishment fee for a home loan. Setting up an SMSF generally involves obtaining a ‘trust deed’, a trustee and signing a trustee declaration, all of which aren’t usually free.

Various SMSF fee breakdowns show it can cost around $550 to set up an SMSF. If you go down the route of having a corporate trustee (regulated by ASIC and generally recommended) then the establishment costs can generally cost $1,600, potentially going as high as $2,000. An earlier report on SMSF fees by Rice Warner in 2013 found these establishment fees can cost $345-900 and $916-$2,035 respectively on average, although this report could be slightly out of date. The difference between these fees is whether you use a corporate trustee or not.

SMSF ongoing/operating costs

Setting up an SMSF isn’t a one-and-done either, and there are quite a few ongoing expenses you have to pay on a regular basis. These costs can include things like:

- Annual ASIC corporate fee & supervisory levy

- Audit fees

- Administration fees (for processing and preparing statements, lodging statements etc.)

- Fees for financial and tax advice

- Relevant legal fees

- Insurance fees (if applicable)

- Actuarial certificates if members are paid an income such as a pension

SMSFs generally do not charge fees if they are linked to a bank account. Some of these funds can either be paid by you directly or by third-parties such as an SMSF administrator, depending on the level of involvement you want to have with your fund.

Operating and ongoing costs will usually be a major component of overall SMSF costs, although investment management fees can often take up a larger chunk. The 2017/18 ATO SMSF review found the average operating cost for SMSFs was $6,152, while the median was $3,923. The 2013 Rice Warner report meanwhile found the average annual cost of operating an SMSF was between $1,163 and $2,367, while an SMSF with a full-administration service can cost as much as $8,000 to run.

Operating expenses – average and median

|

Operating expenses |

2017–18 |

2016–17 |

2015–16 |

2014–15 |

2013–14 |

|---|---|---|---|---|---|

|

Average |

$6,152 |

$5,978 |

$6,219 |

$5,518 |

$5,301 |

|

Median |

$3,923 |

$3,840 |

$3,925 |

$3,620 |

$3,514 |

Source: ATO

SMSF investment management costs

You can also be charged an investment fee on your SMSF, which like superannuation is the cost of actually investing the money in your fund. According to the ATO’s data:

- The average investment expense in 2017-18 was $10,024;

- The median investment expense was $5,311

The median is the more relatable number since the average can be skewed by a small number of accounts with extremely large balances, so you can generally expect to pay around $5,000 for the joy of investing with your SMSF. And the larger the fund, the larger the investment fee. A balance of $1 to $50,000 charges a median $149 in investment fees, while a fund of over $2 million charges a median $10,734.

Median SMSF investment fee (2017/18)

|

|

$1-$50k |

>$50k-$100k |

>$100k-$200k |

>$200k-$500k |

>$500k-$1m |

>$1m-$2m |

>$2m |

All funds |

|---|---|---|---|---|---|---|---|---|

|

Investment fee |

$149 |

$711 |

$3,877 |

$4,399 |

$4,880 |

$6,371 |

$10,734 |

$5,311 |

Source: ATO

You can see a total breakdown of the ATO’s review of SMSF fees here.

When are SMSFs not worth the cost?

Whether an SMSF is “worth the cost” or not will ultimately be up to you, and you might be the type who considers a greater cost a good price to pay for greater control. Factually speaking though, many SMSF fees are fixed expenses, and the higher the amount you have in your SMSF the better value it provides. For example, here is a breakdown of the SMSF average (not median) expense ratios by fund size, 2017–18:

|

Fund size |

Operating expenses |

Total expenses |

|---|---|---|

|

$1–$50k |

8.2% |

15.4% |

|

>$50k–$100k |

3.4% |

7.3% |

|

>$100k–$200k |

2.2% |

6.7% |

|

>$200k–$500k |

1.3% |

3.7% |

|

>$500k–$1m |

0.8% |

1.7% |

|

>$1m–$2m |

0.5% |

1.0% |

|

>$2m |

0.3% |

0.7% |

Source: ATO

Using these figures, only balances of $1 million or more would be deemed “acceptable investments” according to that generally accepted ‘1%’ benchmark for total fees, although this is the average fee breakdown - the median, as demonstrated throughout this article, would likely be lower.

In late 2019, ASIC cited a Productivity Commission (PC) report stating that SMSFs with balances below $500,000 produce lower returns on average, after expenses and tax, when compared to industry and retail super funds. This might suggest that only SMSFs with balances above $500,000 are worth it.

“SMSFs may be an attractive option for investors wanting more control over their superannuation investment strategy, but it requires real skill, care and diligence to manage your own superannuation,” ASIC Commissioner Danielle Press said at the time.

“SMSFs are not for everyone simply because not everyone can meet the significant time, costs, risks and obligations associated with establishing and running one.”

ASIC said if your balance is below $500,000, ask your adviser why an SMSF is the best option for you.

“ASIC’s research also found that SMSFs are not an appropriate investment option for people who want a simple superannuation solution, particularly if they have a low level of financial literacy or limited time to manage their own financial affairs,” the report said.

“On average, SMSF trustees spend more than 100 hours a year managing their SMSF.”

Don’t forget SMSF tax deductions

While SMSFs can be quite expensive at times, many of the costs associated with them are tax-deductible, as SMSFs are considered an investment. As a general rule of thumb, any SMSF expense directly related to generating taxable income is deductible. According to the ATO, such expenses include:

- Accountant and investment advisor fees

- Audit fees and actuarial fees

- Admin and investment costs

- The cost of updating the trust deed

- Insurance premiums through the SMSF

Meanwhile, fees that are NOT tax-deductible include things like upfront/establishment costs and any fees or penalties you might incur, such as late lodgement fees for documents.

These deductions need to be claimed in the financial year the expenses took place in usually, and like most tax deductions you’ll need proof in the form of receipts or statements. Tax can get quite tricky at the best of times and SMSFs can complicate everything, so you should check out the ATO’s complete breakdown of SMSF tax deductions and contact a tax agent or financial advisor for more detailed information, as well as personal advice.

Savings.com.au’s two cents

SMSFs aren’t a straightforward product in most cases, and as the numbers show, the numerous fees they charge can add up to quite a lot. The data shows they’re generally only worth the investment for higher investment amounts, so unless you’re someone with a lot of money to invest (at least $500,000 according to ASIC) and have quite a high understanding of money, tax and investments, you might be better off just sticking with your regular old super fund to stash your retirement savings in.

This may not always be the case though, so if you’re considering opening an SMSF, consider speaking to a financial advisor or registered tax agent who can tell you more based on your own circumstances.

Aaron Bell

Aaron Bell

Denise Raward

Denise Raward