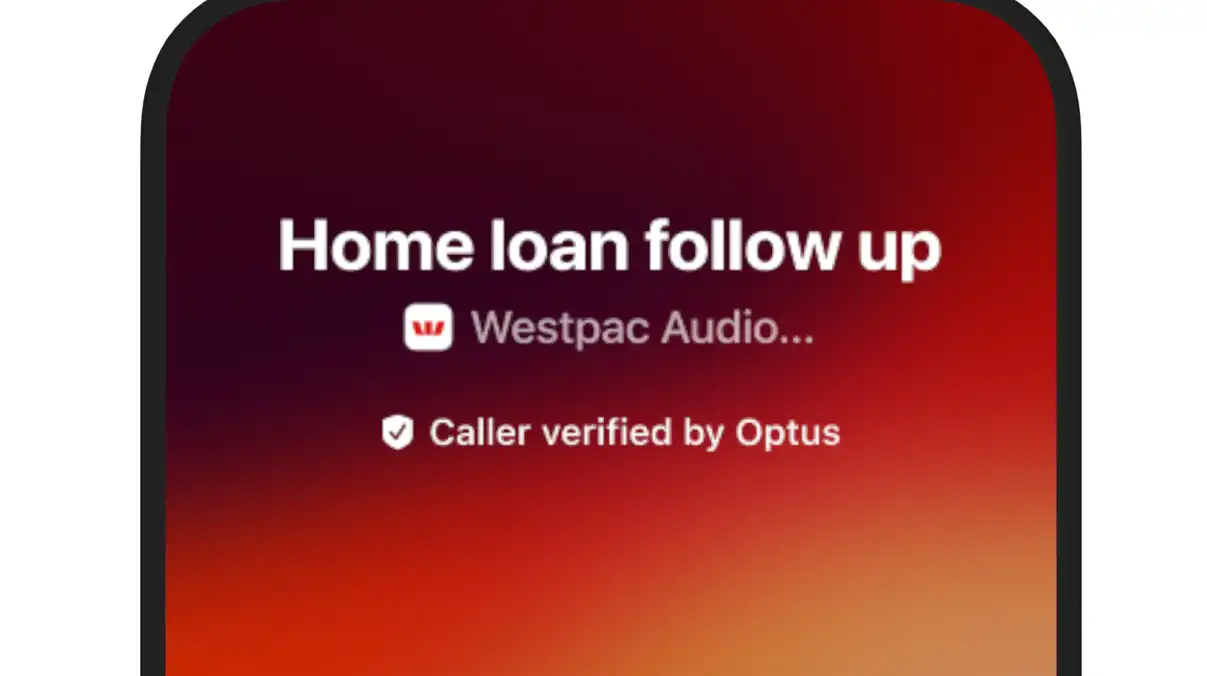

Westpac has teamed with telecommunications provider Optus to develop technology which will see calls via the bank's app come through as Westpac branded and verified by Optus.

The contact will also display a reason for the call on customers' phones.

The new capability is designed to give Westpac customers more certainty they are legitimately being contacted by the bank.

Dubbed 'SafeCall', the new technology will be rolled out over the coming months, also allowing customers to call the bank through the app.

Bank fightback

According to a 2023 ASIC report, big four bank customers lost more than $550 million to scammers in the 2021-2022 financial year, up 50% on the previous year.

ASIC called on banks to do more to protect their customers, noting they had to bear 96% of total scam losses across the four banks.

Westpac CEO Peter King said the new technology is designed to make Australia a harder market for scammers to operate in.

"This will help to provide customers with the confidence and added security to help beat scammers and know that they really are talking to their bank," he said.

Westpac said it's currently detecting 69% of all scams coming through its operations.

It claimed it's stepped in to save customers more than $400 million in scam losses over the past two years.

Bank customers remain scam targets

In recent years, scammers have become increasingly sophisticated, making a call appear to come from a legitimate phone number and texts to appear in the same conversation thread as genuine messages from banks, called spoofing.

Such scams have seen every cent drained from some customer bank accounts.

The Australian Competition and Consumer Commission's Scamwatch has urged customers to be immediately critical of any alleged correspondence from a bank.

The ACCC said it was important to remember banks won't ask customers to urgently transfer funds.

Impersonation scams accounted for more than 70% of cases reported to Scamwatch last year.

The ACCC said it was encouraging to see a 13% drop in reported scam losses to a total of $2.74 billion dollars in 2023 although it said the figure remains too high.

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

Image supplied by Westpac

Rachel Horan

Rachel Horan

William Jolly

William Jolly

Emma Duffy

Emma Duffy