Business vehicle finance

Whether your business needs a single car or a fleet of trucks, there's likely to be several ways you can finance so it's worth exploring them all. To help, we've compiled summaries of some of the most popular business car financing options below, giving you an overview of the pros and cons of each.

Make sure you speak to a registered tax agent or consult the ATO for anything tax-related in this article.

Chattel mortgages

Chattel mortgages are essentially secured car loans for businesses. These loans function in pretty much the same way as a standard consumer car loan you're probably familiar with. A lender gives the business the money to buy the car, which is then paid back (plus interest) over the loan term. If the business defaults on the loan, the lender has the right to repossess the car.

Also useful for any plant or equipment, chattel mortgages involve the 'chattel' - i.e. the car - secured to a loan (mortgage) you have to pay back. Ownership of the vehicle transfers to you straight away, but the financer can take it back if you fail to meet repayments.

Purchasing a car via a chattel mortgage can allow a business to claim a variety of tax deductions:

- You can claim the GST on the purchase price

- You can claim the full input tax credit

- You can claim the interest paid on your repayments

- You can claim tax breaks on depreciation, up to the depreciation limit

In general, a car can only qualify for a chattel mortgage if more than half of its usage will be for business purposes.

Chattel mortgage pros and cons

Pros

- You own the vehicle from the outset

- Plenty of tax deductions available

- As secured loans they can attract lower rates than unsecured loans

- Interest rates are generally fixed

Cons

- You’re locked into the loan unless you pay a termination fee

- The asset is secured, so you can lose it if you can’t meet repayments

- Loans are recorded on your balance sheet, reducing borrowing capacity

- They don’t fall under the National Consumer Credit Protection Act (NCCPA)

Business loans

Standard business loans can be taken out to fund any purchase for a business, including cars. Like a personal loan, business loans are usually more flexible than chattel mortgages in that they can be either secured or unsecured and aren't tied to a single purchase. You could take out a $100,000 business loan and spend $20,000 of that on a vehicle, then use the rest for other operating costs.

Some businesses may prefer an unsecured loan because they don't want to risk their car being repossessed by the lender over failed repayments. However, the lack of security for the lender on unsecured loans means they tend to come with higher interest rates than secured loans.

Like a chattel mortgage, the interest costs on a business loan can be tax-deductible, as are things like the car's depreciation costs.

Business car loans pros and cons

Pros

- Can be secured or unsecured

- The borrowed funds can go towards anything for the business, not just cars

- Competitive rates can be found

- Your business owns the asset from the beginning

- Interest repayments can be tax-deductible

- Repayment schedules can be flexible

Cons

- Secured business loans mean the lender can repossess the asset

- Unsecured business loans attract higher interest rates

- Rates, in general, can be higher than some of the other options here

- Has to be recorded on balance sheets

- Applications can take a while

Commercial hire purchases

Hire purchases are quite similar to business car loans in that you'll still make regular fixed repayments towards a car. Unlike car loans though, the lender purchases the car on your behalf and hires it back to you until all loan payments are completed. This can be a good option for businesses who don't want to be tied down to a long-term loan, although you do still have to pay an upfront deposit. Once all repayments have been made, only then does your business completely own the car.

Commercial hires also have some tax benefits - like car loans, interest repayments can be tax-deductible. But since the Australian Taxation Office treats hire purchase agreements as 'notional sale and loan transactions', your repayments (usually monthly) are not charged GST.

Commercial hire purchase pros and cons

Pros

- You can claim depreciation and interest charges on tax

- Repayments are GST-free

- Repayments are flexible and fixed, so you know what you’re paying upfront

- Upon completion, the car’s ownership is automatically transferred to you

Cons

- You’ll still likely need to pay an upfront deposit

- The car is owned by the financer until the end of the purchase contract

- Early termination fees apply

- Can be more expensive than other forms of finance

- You still have to pay for servicing and repairs on a car you don’t own

Vehicle leases

Vehicle (or just finance) leases are very similar to hire purchases, as they also involve the financer buying the car and lending it to you over an agreed period of time, which is usually two to five years. When the lease ends, you have the option to:

- Buy it by paying the residual amount (the balloon)

- Upgrade by taking out a new lease and starting again.

This gives you the advantage of not being stuck with an aging vehicle that no longer serves your business any purpose. Another advantage of a finance lease is the payments can be tax-deductible as a business expense.

Operating leases

An operating lease is a kind of lease where you agree to finance a vehicle for less than its useful life, which for a car might be any length from a few years to more than 10. With an operating lease, the lessee is not responsible for the residual value at the end of the lease – the car is simply handed back to the finance company. This can make them useful for businesses with a higher turnover of vehicles.

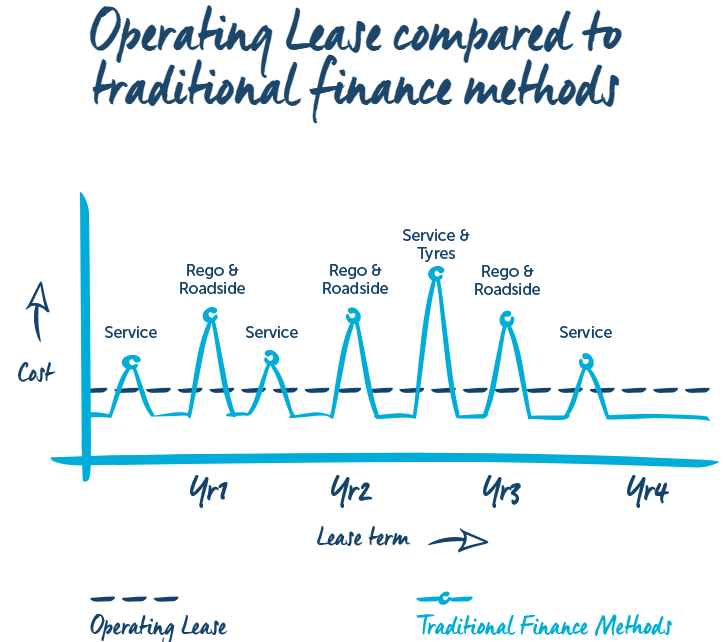

Another key advantage of operating leases is fixed operating and maintenance costs (like maintenance, registration and roadside assistance, servicing etc.) can be included in the lease payment. While this can make operating leases more expensive, it can make it a lot easier to pay since all of these costs are bundled into the lease into regular monthly payments.

Finance leases and operating leases are similar but differ in a couple of ways:

- Who owns the car: at the end of a finance lease, the lessee (you) becomes the owner of the car, but with an operating lease the lessor retains ownership.

- Balloon payments: finance leases often require you to make a balloon payment at the end to take ownership of the car, but you don’t have this option with an operating lease

Car lease pros and cons

Here are the pros and cons of leases in general when using them for a car. Read our article on leasing vs car loans for more information.

Pros

- Leasing instead of buying means there’s no debt to record on your balance sheet

- Finance leases can have cheaper recurring payments

- Leasing can be a flexible choice – you aren’t tied down to a single vehicle

- Lease payments are generally tax-deductible

- Easy maintenance, since many leases include maintenance costs in the repayments (mainly operating leases)

- You can more easily get the latest and safest cars

Cons

- Repayments can be higher than other methods if maintenance costs are included

- You don’t own the car, similar to commercial hire purchases

- You can’t make any modifications

- Some leases have restrictions (e.g. some might place restrictions on how many kilometres they can be driven)

- Can be more expensive overall than methods that allow you to own a car

What about novated leases?

A novated lease is a type of lease that allows your employees to lease a vehicle using their own pre-tax income. Using this method, you (the employer) arrange for the lease repayments to be taken straight from the employee’s salary, reducing their taxable income.

This can be a pretty lucrative deal for employees, but it shouldn’t be offered to just anyone. You might want to be assured of their long-term commitment to your business before allowing them to take out a novated lease.

According to the Melbourne Institute’s HILDA report (Household, Income and Labour Dynamics in Australia Survey) for 2019, 15.9% of Australian employees reported having some sort of salary sacrifice agreement with their employers, which often includes cars. This is a1.6% increase since 2010, and these salary sacrifice agreements have a mean value of $6,787 per year.

Good old cash

If you have the capacity to buy a car outright without requiring finance, using cash can be a good choice. It’s certainly cheaper than most other options since there are no interest charges or fees on buying 100% of a car upfront. This isn’t always an option, but it’s worth considering if your business has the money to spare.

How do you choose the right product?

When buying a car or two for your business, you have plenty of financing options to choose from. That's why you should ask yourself the following questions, about both the car itself and financing:

- What will the car be used for? Immediate savings can be made by choosing the right type of car: will you be using it to transport heavy goods? Will you be making long trips? Or will you be transporting people around? Owning a car is expensive, so factor in the cost of insurance, registration, fuel and ongoing maintenance when considering the different car models.

- Should you get a new or a used car? Used cars are often cheaper than new ones and can often mean great deals if they’re still in good condition. On the other hand, used cars can be more costly to borrow with certain products like car loans – used car loans often have higher interest rates than new car loans since used cars represent a greater risk to the lender.

- Do you want to own the vehicle? If you want to own the vehicle from the outset instead of a dealer or finance company owning it, then options like a loan or chattel mortgage might be more practical. Options where you don’t own the car however, like a lease, can be more flexible for businesses.

- How’s your business performing? How much money your business is making and what the cash flow is like should also impact your decision. For example, businesses with seasonal income might want to consider something like a chattel mortgage with repayments due when your income arrives.

- What are the tax implications? Read about the tax breaks your business can claim above, as well as some other deductions that can be claimed below to help make your decision.

If you’re buying a substantial number of cars (often 15 or more) many lenders and dealers offer discounts for ‘fleets’. There are also specific fleet management companies who offer finance for fleets, whether these are cars, trucks or other vehicles.

Tax implications of using a vehicle for your business

As you might've gathered from how many times the word 'tax' cropped up throughout this article, there are tax benefits to owning or financing vehicles as a business owner. We'll cover the main benefits here, but we'd also recommend seeing a registered tax professional for more personal or detailed advice.

First of all, the Australian Taxation Office (ATO) states that any motor vehicle owned, leased or under a hire-purchase agreement by a business can have the following expenses deducted come tax-time:

- Fuel and oil

- Repairs and servicing

- Interest on a motor vehicle loan

- Lease payments

- Insurance cover premiums

- Registration

- Depreciation (decline in value).

We've already mentioned a few of these - for example, car loans and chattel mortgages let you claim the interest component of your repayments, while other options like commercial hire-purchases can also let you claim GST on the purchase. Other expenses like fuel and oil or repairs can still be claimed even if it's one of your employees using the car - they just have to provide proof. This can be done by either keeping receipts of things like fuel refills or keeping a logbook of distances travelled.

Expenses are only deductible if they are used for business purposes. So if the car is used by you or an employee for both business and personal use, only the business component can be claimed. If you take your company car on a beach trip one weekend, you unfortunately won't be able to claim the fuel you use as a business expense.

Claiming expenses and how you calculate them will depend on:

- Your business structure (i.e. sole trader, company, partnership or trust)

- The type of vehicle

- How the vehicle is used.

It's important to get it right, or least do your best to be as accurate as possible because submitting an inaccurate or misleading tax return for your business can result in big fines from the ATO. At the bare minimum, you'll have your claim reduced or struck off if caught.

What about individuals claiming tax-deductions on their car for businesses purposes?

If you’re driving your own car for the purpose of conducting business, then the ATO states you can make similar deductions:

- Carrying tools or other equipment needed for your job

- Travelling from home to an alternative workplace (like a client’s office) then back to your main workplace or home

- Travelling to meetings, conferences or events required by your employer

- Travelling between two separate workplaces where you are employed and delivering or picking up items, as required by your employer.

Car-related expenses account for roughly 40% of all work-related tax deductions, and you can read some tips on what you can claim here. Also check the ATO for more information on tax-benefits for car ownership, because there’s a lot of it.

Frequently asked questions

To take out a business car loan, it’s important to meet all the requirements of the loan and have all the correct documentation on hand, which can include: identification paper, budgeting, financial records, proof of ownership of the business, information about your own personal finances and proof of insurance.

There are two ways you can estimate depreciation on a car:

- Prime cost depreciation: Asset’s cost × (days held/365) × (1/asset’s effective life)

- Diminishing value depreciation: Base value × (days held/365) × (2/asset’s effective life)

Prime cost depreciation assumes the vehicle loses the same amount of value each year, while diminishing value assumes the vehicle will lose more value in the earlier years. Using diminishing value can be useful since bigger claims can be made in the first couple of years of ownership, so if the vehicle is sold before the end of its effective life, you will have received more deductions. By the end of the effective life though, you will have received less overall than by using the prime cost method.

Below is an illustration of how much depreciation you can claim for both over eight years, using a $40,000 vehicle

| Year | Prime cost | Diminishing value |

|---|---|---|

| 1 | $5,000 | $10,000 |

| 2 | $5,000 | $7,500 |

| 3 | $5,000 | $5,625 |

| 4 | $5,000 | $4,218.75 |

| 5 | $5,000 | $3,164.06 |

| 6 | $5,000 | $2,373.05 |

| 7 | $5,000 | $1,779.79 |

| 8 | $5,000 | $1,334.84 |

| Total | $40,000 | $35,995.48 |

Savings.com.au’s two cents

Having a car or a fleet of cars for your business is almost required nowadays, and even if you’re a small business with few employees, there’s a good chance you’ll need to drive somewhere or transport something as a part of your business operations at some point.

While cars and other vehicles aren’t cheap, the good news is there are heaps of options available for businesses to choose from – even more than there are for individuals. So with plenty of options to choose from, it’s important to pick the right one. Remember that a car for your business is purely an asset, so take emotion out of the equation: while a flashier car might look nice, can your business afford the extra few thousand dollars? And is that shiny new Mercedes even the right fit for what you need?

It’s also tempting to focus on the tax effectiveness of the various methods, but what’s ultimately the most important is that you drive a hard bargain by choosing a combination of a low-price car with low-cost finance. Even with tasty-looking tax exemptions, one product can still be more expensive than another.

This article was originally written by William Jolly in 2019, and updated by Harry O'Sullivan in May 2023.

Hanan Dervisevic

Hanan Dervisevic

Dominic Beattie

Dominic Beattie