The government has already introduced a stack of measures designed to help Australians through the COVID crisis, like JobKeeper, JobSeeker, mortgage deferrals and early superannuation access - to name a few.

But there are also steps you can take to manage your finances. COVID has shown us it’s more important than ever to save money - particularly if you’re one of those unfortunate souls who have lost their jobs or had their income reduced.

Here are some ways to manage your money during COVID and ‘recession-proof’ your finances.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest non-introductory and introductory interest rates on the market.

- A high-interest online savings account with no monthly fees, easy withdrawals and award-winning digital banking

- No withdrawal notice periods or interest rate penalties

- Save up to 10% on eGift cards at over 50 retailers with Macquarie Marketplace

Top up your emergency fund

COVID-19 has shown us exactly how important it is to have emergency savings with many people suddenly losing their jobs or facing a reduced income.

If you’re lucky enough to still be employed, use this time to funnel away as much money as you can into your emergency savings - after all, we won’t be going on any overseas holidays for quite a while!

A general rule of thumb is to have between three and six months' worth of living expenses saved up in your emergency fund because, according to Seek, this is how long it takes most unemployed people to find another job. Of course, in a recession, it could take even longer than this to find a job, so it doesn’t hurt to squirrel away as much money as you can afford.

Here’s our step by step guide on how to build an emergency fund.

Get rid of your debts

Focusing on paying off your debts is something you should always focus on doing, but it’s arguably even more important to do so in a recession when job uncertainty is very real and could impact your ability to make those repayments.

If you have multiple debts, make a list of each one along with the outstanding balance, interest rate, the minimum repayment, and the date payments are due. Yep, this can be super intimidating but looking at the numbers in the cold hard light of day is the only way to truly tackle your debt.

A good rule of thumb is to begin by paying off your most expensive ‘bad’ debt first. For most people, that’s usually a credit card or a personal loan.

Credit cards and personal loans

If you’ve got credit card debt or personal loans like a car loan, these are the most urgent debts to pay off first. Why? They’re what’s known as ‘bad debts’.

‘Bad’ debt is anything that’s used to fund your lifestyle (like maxing out a credit card for new clothes) or spent on things that go down in value over time (like a car). Credit cards and personal loans also typically charge much higher interest rates than other credit products like a mortgage (which is considered a ‘good' debt because property can build wealth).

Even if you haven’t lost your job, it’s still a good idea to focus on getting these debts paid off ASAP just in case your situation changes and you find yourself in an unenviable position where you’re suddenly unable to make your repayments.

Your credit card debt will never budge if you’re only making the bare minimum monthly repayment, so pour any extra money you have into paying off your debt. Tax refunds are ideal for this.

You may also want to consider consolidating your credit card debt by moving your debts across to another credit card with a 0% balance transfer interest rate. Keep in mind that the 0% interest rate is only for a set period of time (usually up to 26 months) so if you don’t pay off the balance within this interest-free period, you could be hit with a high revert rate - balance transfer revert rates can be as high as 24%! Unfortunately, the banks count on this happening so they can suck even more money out of you, so make sure you pay off your debt before the introductory period ends.

Another option is to consolidate your debts through a personal loan with a potentially lower interest rate. This can help you avoid paying multiple credit card fees and force you to pay more than the 2% or 3% monthly minimum due to the payment structure.

If you need more ideas, here are ways to keep credit card debt off post-COVID.

Generate another income stream

If you can, try and generate another source of income. If you’ve recently lost your job, don’t expect to make a full-time income from a side hustle. Instead, think of it as a way of earning a bit of bonus cash to tide you over.

A recent Gumtree report found that the average Australian household is sitting on a $5,800 goldmine of unwanted items which, at a time when many people have found themselves out of work or with a reduced income, is a pretty decent amount of money.

If you’re a dab hand with a sewing machine, you could try making your own reusable face masks and selling them online on sites like Etsy - I hear there’s a lot of demand for them at the moment.

For more inspiration, here are eight ways to make money online.

Make sure you’re getting the best deals on financial products

Cutting unnecessary expenses is even more important during this time as Joel Gibson, campaign director of One Big Switch and author of KILL BILLS! can attest to.

The former reporter and editor at the Sydney Morning Herald saved over $3,000 on his household bills in one year and says people should start making simple switches to save money and then move onto the bigger bills.

“I think the simplest switch is mobile, because you can take your number with you, it takes a matter of minutes, it's 100% free and you can usually do it all online too,” Gibson told Savings.com.au.

“Some people will be amazed by this, but let’s say you want 60GB of pre-paid data a month - there’s a difference of over $1,000 a year between a cut-price carrier like amaysim and a big legacy brand like Telstra. Why pay $1,000 more if you don’t need to?

“Even with more medium-sized plans like 30GB, the difference can be well over $100 and sometimes over $200. So make sure you're not paying hundreds more than you should be and if you are, switch in minutes and save.”

Once you’ve tackled your phone bill, Gibson says your energy bill should be next especially as they’ve been soaring with more of us spending time at home during COVID.

“If you're not confident doing the comparison yourself, it's never been easier thanks to amazing government websites in most states that now read your bill and scan the market and tell you which plans are the cheapest for you,” he said.

“The Australian Energy Regulator says the cheapest plans around cost $300-$400 less than the Government’s ‘Default Price’, which is probably what you’re on if you haven’t shopped around and switched for a while.”

When it comes to household bills, Gibson said too many of us make the mistake of setting and forgetting.

“You might have been on a cracking telco or electricity or insurance deal but leave it for a couple of years and you'll often find it's now a dud,” Gibson said.

“Markets like telco and energy and insurance move fast so you need to take a look at your deals once a year and make sure they haven't left you behind. Bills are like your car or your home: they need maintenance and if you skip it, it'll cost you big bucks in the long run when small problems become big ones.”

Another big mistake costing Aussies is brand loyalty.

“Researchers have estimated we waste over $6 billion a year by not shopping around and switching more often when we see a better deal,” Gibson said.

“The great thing about the new breed of providers like amaysim is that they don’t have lock-in contracts, so if you are shopping around, you've still got the freedom to switch your plan or cancel at any time. Whether it's mobile or energy or Pay TV, the days of having to sign a 12 or 24-month contract to get a great deal are long gone.”

Gibson, who has teamed up with amaysim to encourage Aussies to shop around, has a few insider tips and tricks to help people save:

The ‘mystery shopper’ method

Gibson says he learnt this method from a former CEO of a major finance company.

“Every year he'd get his renewal notice with a 10% or 20% premium increase and every year he'd jump on his own provider's website, enter all his policy details but use his neighbour's address so they didn't recognise him, and see what they were quoting a new customer,” Gibson said.

“If it was less than his premium, he'd then ring them up and say 'Why should I pay more than a new customer? Am I being punished for my loyalty?' Nine times out of 10 they'd play ball and he'd save money.”

The De-Niro

“The most important one I call ‘The De Niro', after a character in a 1995 movie I love called Heat. He says 'Don't let yourself get attached to anything you are not willing to walk out on in 30 seconds flat if you feel the heat around the corner,’” Gibson said.

“It's the same with household bills! We need to be unsentimental and willing to walk if we don't get what we want. There's so much competition in most industries and the only thing that's missing sometimes is our willingness to take a chance on a new provider or a new deal.”

The Elizabeth Taylor

This method is about taking ‘honeymoon deals’ - where you get a great offer for a limited period of time before the price increases.

“Those deals are ok as long as you're prepared to move when it expires. Move often enough and you can take honeymoon after honeymoon after honeymoon, just like Liz Taylor,” Gibson said.

Create a budget and cut spending

If you don’t already budget, there’s no time like a recession to get started. Budgeting doesn’t have to be this big scary thing - it’s simply a means of working out your income and spending.

Start by calculating your take-home pay (after-tax). If you’ve lost your job and no longer have any income, you’ll (hopefully) already have between three and six months worth of living expenses that you can dip into. Give yourself a set amount of money each week from this - just enough to cover all the bare essential expenses (housing, food, utilities). If you’ve lost your job or had your income reduced you may also be eligible for JobKeeper or JobSeeker payments, which now counts as your take-home pay.

Then make a list of all your expenses, like rent or mortgage repayments, food, utility bills, etc. Once you know how much money you have leftover from your pay after all your essentials have been paid for, then you can work out how much of that to save and how much you have left to play with.

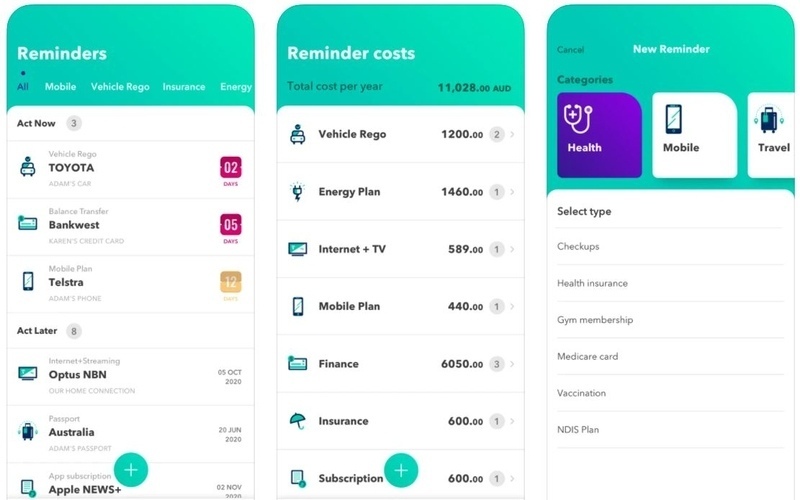

It’s a good idea to download a spending tracker app or just manually go through your bank statements and see if there are any regular expenses coming out that you’ve forgotten about, like an unused Netflix subscription. You may be surprised to find spending habits you didn’t even know you had, like getting Uber Eats way more than you thought you did.

For more ideas, check out our in-depth guides on how to budget, the best budgeting apps, and practical ways to save during COVID-19.

Get your mortgage sorted

Fun fact: did you know the word ‘mortgage’ literally means ‘death pledge’? Yep, the ‘mort’ in mortgage is derived from an Old French term meaning ‘dead’ while ‘gage’ means ‘pledge’. The things you learn!

Anyway, if you’ve got a mortgage, you should focus on getting it paid off as quickly as possible. If you’re in a position where you can’t pay it off, most banks are offering temporary mortgage deferrals during this time.

While that support is now coming to an end, most banks are allowing customers who are still experiencing financial hardship to continue deferring their repayments. Check with your bank and find out what ongoing support they’re offering to customers.

Refinance to a lower rate

After the Reserve Bank’s last five (yes, five!) cash rate cuts, home loan interest rates are the lowest they’ve ever been. This means there are big savings to be had by borrowers.

For example, if you were on a 4.5% p.a. interest rate on a $350,000 loan balance for 20 years and refinanced to a 2.47% p.a. interest rate, you could save $381 a month - that’s $114,161 over the life of the loan!

If you think your current home loan interest rate is too high (rates have fallen well below 3%) you’re probably right and it might be time to think about refinancing.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

Sort out your superannuation

Our superannuation portfolios are made up of heaps of different assets including shares - which have been volatile to say the least during the COVID crisis. As a result, superannuation is yet another thing impacted by the recession and many Australians are facing a smaller retirement savings balance than they were pre-COVID.

However, it’s important not to panic about short-term fluctuations. If you’re young and just starting out in your career, you still have decades to ride out the highs and lows, so resist the urge to frequently login and check your super balance. And if you do login, try not to freak out too much if you see that your super balance has shrunk. The reality is markets go up and down all.the.time.

One thing you can do however, is make sure you only have the one super fund. If you have multiple superannuation accounts, you’re paying fees on all of them which will just shrink your super balance even more. It’s pretty easy to consolidate your super, all you have to do is login to the MyGov website and follow the prompts.

If you’re worried about your super balance, it may be tempting to move your super into a lower risk option like cash but founder of AJ Financial Planning, Alex Jamieson, says doing so means you essentially risk missing out on gains through the increased value of growth-based assets due to unconventional monetary policy.

“A large amount of academic research has identified a key link between the usage of these monetary tools and increasing the value of growth-based assets being shares and property over the medium term,” Jamieson told Savings.com.au.

“This is contrasted to cash and fixed interest-based investments at a considerable disadvantage during this period of time.

“The only way to capitalise on this monetary policy trend is to hold some exposure to growth-based assets rather than cash.”

In short: consolidate your super, resist the temptation to check your super balance if you know what’s good for you, and consider holding off moving your superannuation to a low risk profile because you may lock in any losses.

What to do if you’re about to retire

On the other hand, if you’re reaching retirement age it’s understandable to be more concerned about your retirement savings because you essentially have less time for your balance to recover. Jamieson says this is often referred to as ‘sequencing risk’ which means the risk of a downturn at the same time of starting retirement.

“The risk with this event is that your retirement benefits longevity may be shortened. The good news for the pre-retired is that they have not yet retired,” Jamieson said.

“Historically, international investment markets that have fallen by 20-40% have on average recovered within 15 months time since 1945 once dividends are taken into account.

“Anybody contemplating retirement may simply look to delay this start date until then.”

How to boost your balance if you’ve withdrawn your super early

If you’re one of the 3 million+ Australians who have withdrawn their super early under the early super withdrawal scheme, getting your super balance back on track may not be your most pressing concern right now if you’re under enough financial strain to need to dip into your super in the first place.

But it’s important to at least start thinking about what steps you can take to make sure your superannuation recovers so that you won’t be broke in retirement.

Jamieson says people should consider taking a multi-prong approach to boost their super balance.

“This could involve taking advantage of the co-contribution program if you are eligible for this government program, as could also potentially increasing the amount you are salary sacrificing into super,” Jamieson said.

“Even an extra 1% going into super over the long run can make a difference. You may look to also review your investment options and possibly consider the merits of taking on a higher allocation to growth-based assets.”

Here’s our guide on how to catch up after early super release.

How to manage your investments during a recession

A recession can be a pretty nerve-wracking time for those of us with investments, but it’s important to remember that the share market always fluctuates, and dips are very normal.

Jamieson says investors need to remember that investing is a long game.

“During periods of high uncertainty it is important to not get too caught with extreme views of the world with the economic outlook, investment options or the future ahead. We often find the reality is somewhere in the balancing points,” Jamieson said.

“It is important that one remains well-diversified and takes advantage of investment opportunities that present with assets being offered up at more favourable prices.

“At this stage, we think it makes sense to remain invested during this pull back and seek out any opportunities that might present in growth-based assets from nervous investors.”

Those with investments may want to consider doing a stocktake of their assets and think about their investing strategy.

“Investors should be reviewing their holdings, essentially identifying which are not adapting to the current environment or struggling with the new realities of life,” Jamieson said.

“If these companies are in failing segments of the market longer term due to disruption it might cause a rethink on this strategy longer term and a potential exit may be warranted.”

What shares are likely to do well?

During a recession, some shares will be hit harder than others and lose their value, while others will rise in value. Jamieson says recessions can present good buying opportunities for investors who are savvy enough to look for them.

“The technology sector has had a fairly nice pullback recently both in Australia, Asia and the US,” Jamieson said.

“Essentially we have seen a fair amount of profit-taking take place, this does present some interesting opportunities. Key areas of consideration could be ATEC, AISA and NDQ ETF's which track these key markets.

“Alternatively biotech has done well on the back of the increase in focus on health, as we progress through this pandemic. The ETF CURE is one example of providing some exposure to this segment of the market.”

Savings.com.au’s two cents

For many of us who aren’t old enough to remember the 90’s recession or were very young when the GFC hit, going through a recession for the first time is equal parts scary and uncertain. Many of us know people who have lost their jobs or had their incomes reduced - maybe you are that person.

None of us know how long this period of economic downturn will last which is why it’s so important to take action now to make sure you’re in the best possible financial position. Living within your means, wiping your debts and saving as much money as you can are key to surviving a recession.

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy