You’d be forgiven for thinking there are an endless amount of cost increases looming ahead of us, and with that comes the fear that you might not always be in control of your finances.

Whether it be rising interest rates, costly petrol and food prices (looking at you, lettuce) or 30-year-high inflation, the cost of living is increasing at a rapid pace. These increased financial pressures mean some Aussies are living paycheque to paycheque.

But there are manageable ways that you can prepare your assets and finances to ensure that no matter what lays ahead, you and your family’s money is protected.

According to the Australian Bureau of Statistics, household spending grew 11.8% in February compared to the same time last year. However, this is the lowest rate since March 2022. Cost of living pressures and rising interest rates have forced Aussies to evaluate their spending habits.

Savings.com.au spoke with industry professionals with experience in economics, finance and budgeting to find out the best ways that Australians can get on top of their money this financial year.

1. Review expenses and shop around for better deals

The Penny for your Thoughts Podcast spoke to financial coach and founder of Inner Money Journey, Betsy Westcott who said taking a little bit of time out of your day to evaluate your expenses will be beneficial in the long run.

“It’s often the things that take you the least amount of time that get you the biggest bang for your buck,” Ms Westcott said.

“Avoid paying the lazy tax and what that involves is looking through your big ticket items that you have going in and out every week.”

Home loan mortgage

This includes - but isn't limited to - comparing home loans to seek out a better interest rate, features such as a mortgage offset account, any fixed rate offers, cashback deals, and incentives for paying more than the required amount each month (into principal part of the loan).

“If you’re a homeowner, look at your mortgage. You can save money per annum just by negotiating a lower interest rate and getting a bit of a discount,” Ms Westcott said.

Insurance

This includes (but not limited to) comparing offers for different insurance types such as: home and contents, electricity, health, life and income protection, pet, vehicles, and others. Comparison tools are an easy way to find out how much you could be saving on each bill.

Service providers

These are the types of costs associated with internet, mobile phone, NBN and electricity.

In many instances, most energy contracts are 12 months so at the 10 month mark it would be worthwhile to shop around and do some research.

Look at other providers who might be able to do a better deal and you could even use this as leverage to ask your existing provider if they can do a better deal on your current plan.

There are three main ‘poles and wires’ suppliers in Australia - Origin, AGL, and Energy Australia - but more than 30 retailers depending on your state and locale, so it pays to shop around. The Australian Government has its own ‘Energy Made Easy’ website where you can upload your bill and see if you can find a cheaper deal.

The same can be done for your phone contract, it doesn't cost anything to do some research and inquire. If you are locked-in to a phone-on-a-plan contract, consider the economics of breaking that contract and moving to a cheaper deal, or holding on to the phone after your contract ends.

Quite often the ‘plan’ part of the device repayment contract is not good value. There are three network providers in Australia - Optus, Telstra, and Vodafone - but more than 30 individual retailers that might provide good bang for buck. Some you may already know such as Aldi Mobile, Amaysim, and Boost.

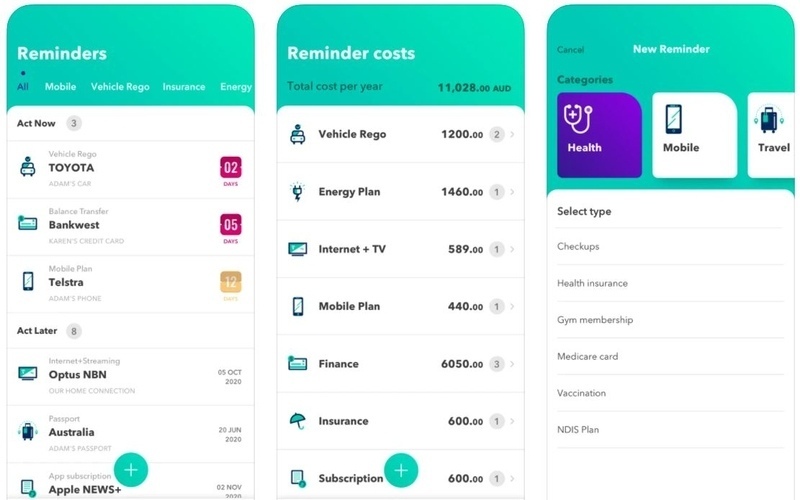

Memberships and subscriptions

It's very easy to get complacent with these costs; often they are smaller amounts being deducted from the accounts and it's not hard for them to go unnoticed.

However, the costs associated with gyms, meal delivery, clubs, sports and music, streaming services (i.e Netflix, Spotify, Stan, Binge, etc), arts, and many others all add up.

Over time these small insignificant charges accumulate and can turn out to be costing you hundreds of dollars a month.

You may also be unknowingly paying each month for subscriptions you no longer use, aren't getting value from, or just didn’t think were continuing. Many people sign up to free monthly trials and then forget to cancel them when the trial ends. So it's always a good idea to review your bank statements every month or so for any unusual debits.

An added lifehack is to go into the settings of your smartphone and check the 'subscriptions' section, this will show you if you are being charged for any apps that you no longer need or use.

Loan services

This includes assessing the rate and features on other loans besides your home loan, including car loans, credit cards, personal loans etc.

Such comparisons can also be done by creating your own excel workbook for all household expenses.

2. Use technology when visiting the supermarket and petrol station

When heading down to your local Coles, Woolies, or BP, Ms Westcott suggests using technology as your friend.

“When you’re filling up petrol in your car, use Fuel Map or Petrol Spy. You can save yourself about $250 per annum any time you go to fill up the car,” she said.

“Also look into SmartCart, Frugl, WiseList and Shopfully. If you have a grocery list, they will show you where you will save more money or who has got the better deal that week.”

A few more tips: don’t go to the shops on an empty stomach as you’re bound to overspend, take a list, avoid the ready made meals and the pre-cut vegetables as you pay a premium for those.

“Also take a look at the unit price costs when shopping at the supermarket,” Ms Westcott suggested.

“For example, the price for a 24 pack of toilet paper is obviously bigger than a 12 pack. However, if you look at the unit price you’ll see that you might only be paying 96 cents a roll instead of $1.60 so you can see immediately that you’re getting better value by buying the 24 pack.”

3. Look for ways to earn money while you're spending

Consider using sites such as ShopBack Super Rewards or Cash Rewards.

“Say you’re doing your grocery shopping and you’re doing it every week online. Rather than going directly to the Woolies website, go to one of these platforms. Every time you spend, you get a little bit back in cash,” Ms Westcott said.

“I did it for my Christmas shopping in 2022 and got about $83 back. I prefer using Super Rewards as the money I get back goes straight towards my super fund which is much more worthwhile as it can grow and compound.”

4. Consolidate loans

In many instances, Australians have multiple loans and are paying interest, maintenance fees and other associated fees on each of these loans

By consolidating your loans they will be rolled into one monthly payment, simplifying and potentially lowering the repayments.

This could include rolling together credit card repayments with a balance transfer, or rolling personal loans into the one if it allows.

5. Review your superannuation strategy

This ensures you have superannuation that works for you.

“Invest a couple of hours one Saturday morning, looking at your super. Make sure it’s working hard and has good, consistent performance over many years, that your fees are low, and that you have the right insurances,” Ms Westcott said.

“That act alone could make you tens of thousands of dollars richer. Three hours of work is worth it in the long run.”

In other words, work out the current strategy that is best suited for you and gives you the greatest advantage. You might not be able to control future performance, but you can control the fees you pay.

6. Top up your mortgage offset account

Many people don't understand the 'double bonus' when increasing the amount in a mortgage offset account, even if it's just by a little bit.

Having a higher balance in your mortgage offset account now can provide you with cushioning when your home loan repayments increase. ‘Interest saved’ can also be better than ‘interest earned’ because products like savings account interest is taxed as regular income.

7. Have a Plan B

Managing Director of Benevolence Financial Group Samuel Philipos said budgeting to have clarity and perspective on ongoing fixed and discretionary costs will help people to build healthy relationships with their money.

"Allocate surplus income to reducing or repaying non-deductible and sometimes deductible debt," Mr Philipos said.

"This is in preparation for interest rate rises that are more severe than your increase in income and is particularly important for people that have fixed rate loans set up in 2021 and maturing in 2023/2024."

Establishing and maintaining a healthy cash reserve is paramount for emergencies and unplanned expenses or events.

These unforeseeable circumstances can come in the form of ill health, redundancy, an increase in mortgage repayments - especially when the fixed rate matures and due to a depressed property valuation, it isn't able to be refinanced.

Having a strong Plan B for ill health events is wise - one shouldn't get caught out thinking that if they live well, eat well and exercise they are immune to a critical illness. You never know what's around the corner.

8. Take advantage of high interest savings and term deposit accounts

Yes the RBA’s increased interest rates will affect borrowing households, however borrowers with cash savings may potentially start earning better interest.

A number of banks have passed on the RBA's 10 consecutive rate rises to savings accounts and term deposits.

Based on Savings.com.au’s market research, there are currently a handful of banks offering accounts over 5.00% p.a. and many others over 4.00% p.a.

For more information, head to our article on: Which banks offer savings accounts above 5%?

How to prioritise expenses

Firstly, it's worth noting that the desire to buy and spend doesn’t necessarily make you impulsive or irresponsible with your money.

David Wright, Founding Director of Spending Planners Institute and author of children’s book ‘Kids-n-Money’, understands the challenges of cutting costs.

"We as human beings are naturally programmed to want to do things that make us feel good, whether that’s buying a coffee, going out for dinner or getting that new piece of clothing, it’s not always easy to say no," Mr Wright said.

"But with tougher financial pressures beginning to mount, it's never been more important to have a spending plan."

In his book 'Kids-n-Money', Mr Wright identifies the 6 types of expenses people will face in their lifetime.

- Weekly living expenses - Food, Fuel, Fun and Incidental Expenses

- Non-Weekly Repeating Predictable Expenses - Bills

- Product Purchases

a) Things they need

b) Things they want - Repairs and maintenance of 'Things'

- Replacement of 'Things'

- Major 'Once in a Lifetime' Occurrences

a) Big Life Goals

b) Unpredictable larger expenses

Mr Wright notes that too many adults allow expense types 1 -3 to consume all of their income, leaving nothing remaining for expenses that fall into types 4-6.

"Classifying expenses into different types is one of the more common methods of dividing your finances, whether that be 'Essential vs Discretionary' or 'Needs vs Wants," Mr Wright said.

"While it is only natural to group expenses in this way, there is a lot more power to be gained in grouping expenses according to their characteristics rather than their purpose.

"When you group by characteristics you're grouping expenses according to their predictability and frequency, rather than by what the money gets spent on. It becomes much easier to take control of them when grouped this way."

Chief Economist at PRD Real Estate Dr Diaswati Mardiasmo believes now is the time to prepare for whatever may lay ahead, to ensure that Australians swim and don't sink.

"From a practical sense we can't just save all of our money or pay; we have living expenses and a standard of living that we want to somewhat maintain," Dr Mardiasmo said.

"How Australians prepare for what is about to come will vary for everyone, depending on their needs and wants, and what their absolute deal breakers - in essence, things they can not live without - and what can be sacrificed.

"Working this out, in an honest brutal truth type manner, is probably the fundamental action in preparing yourself for tougher times."

Image by Ketut Subiyanto via Pexels.

William Jolly

William Jolly

Emma Duffy

Emma Duffy