To paraphrase the late Kerry Packer, anyone who doesn’t try to minimise their tax bill should have their heads examined. Capital gains tax, or CGT, takes a particularly hefty slice of any profit you make from selling an investment property.

Depending on your tax bracket and how long you’ve owned the property for, it could cost you as much as 45% of the profits. That means if you make a $200,000 on the sale, you’ll be handing $90,000 of it straight to the taxman.

But what if you could avoid such a cost? This is where the six-year CGT rule may come in handy although it’s not always a ‘get out of jail free’ card.

What is the six-year CGT rule?

Also called the ‘temporary absence rule’, this concession essentially means you are able to rent out your principal place of residence (PPOR) for up to six years without paying any CGT as you would on the sale of a standard investment property producing rental income.

Just to be clear, what you make in rent will still be treated as taxable income by the tax office, but you won’t have to pay CGT when you eventually sell the property (unless you rent it out for more than six years - more on that below).

The rule can also be used indefinitely if the property is not used to produce income, for example, if it remains empty or you only use it as a personal holiday home.

The big catch is: You cannot treat any other property as your main residence, except for up to six months if you are moving house. This basically means when you move out of your property, you’d need to rent another place or have generous friends or family who’d let you move in with them.

Director of tax communications at H&R Block Mark Chapman told Savings.com.au the six-year rule is an important rule for homeowners who may need to leave their home for a period of time.

“A homeowner may get a job abroad or interstate for a period of time and may choose to rent out their property whilst they are away, fully intending to move back in when their contract ends – it simply wouldn’t be fair not to apply the main residence exemption in such circumstances,” Mr Chapman said.

What is a PPOR?

To satisfy the Australian Tax Office under the six-year rule, the residence must have genuinely been a principal place of residence, or PPOR, to be exempt from CGT.

That means the dwelling must have been your main residence first and to qualify for the CGT exemption you must have actually stopped living there, referred to as the temporary absence rule.

Mr Chapman said this is the main caveat in applying the exemption.

“You need to remember that the absence rule applies only where the property is genuinely empty, irrespective of whether the property is used to produce income,” he said.

“If you remain in the house but rent out part of it - say, on Airbnb - the absence rule doesn’t apply because you are still living there.

“Attempts to ‘game the system’ are a sure-fire way of attracting the attention of the Australian Tax Office.”

Small businesses and homes used for income before moving out

This is where it gets tricky. If you operate out of your home as a small business owner, such as a masseuse, consultant, or any other home-based profession, any part of the house used for your work will be subject to CGT.

For example, if you estimate 25% of the dwelling was used for your business, 25% of the total capital gain will be subject to CGT when you sell the home, while 75% will not under the six-year rule.

In monetary terms, that means if you make a $100,000 capital gain after two years of owning your home, $25,000 of that will be subject to CGT, although there’ll be a 50% discount for holding the asset for longer than a year. So, if your top marginal income bracket is 45%, 22.5% of $25,000 equals $5,625 payable in capital gains tax.

What happens if you move more than once?

For a new six-year period to trigger, the homeowner must move back into the property and treat it as their main residence before it produces income again.

To quote the ATO: “If you are absent more than once during the period you own the property, the six-year period applies separately to each period of absence.”

Mr Chapman said the cycle can continue indefinitely.

“If you rent the property out for, say, five years, then move back in for six months, then rent out the property again for another five years, your entire capital gain will be tax-free,” he said.

“The ‘six-year rule’ resets each time you move back into the property and live in it as your main residence. That means that if you move back in and then later move out again, renting the property to tenants, you get a further six-year absence period during which the main residence exemption is protected.”

What happens if the six-year limit is exceeded?

Any time spent producing income on your PPOR beyond the six-year threshold will be subject to CGT. For example, if you sell the home after seven years, you’ll be subject to CGT based on that one extra year, provided you’ve labelled it as your PPOR for those initial six years.

Case Study - Saving on CGT

Lou Pole buys his Brisbane home as a principal place of residence in 2010 for $500,000. In 2012, he needs to care for his sick sister in Perth. He moves in with her and while he’s looking after her, he doesn’t need to pay rent.

He decides to rent out his Brisbane place while he’s away but keeps treating it as his PPOR for tax purposes.

Three years later, he decides to sell the home. He sells it for $700,000 - a $200,000 gain.

His top marginal income tax bracket is 32.5c on the dollar so without the six-year rule, he would have been up for $32,500 in capital gains tax. But thanks to the six-year rule, he isn’t taxed a cent on this profit.

Six-year CGT rule - pros and cons

The most obvious benefit of the six-year rule is that you can avoid paying a considerable sum in tax. At the same time, the obvious drawback is that you’ll likely need to pay to live somewhere else while renting out your PPOR, so you’ll need to factor this into any income-producing plans you may have.

Pros

-

Save on tax: The rule is designed to limit prohibitive cost and tax burdens when someone leaves their home temporarily, such as for a stint overseas or for work or personal reasons.

-

Flexibility: If you need to live somewhere else for a temporary period, the six-year rule allows you to rent out your PPOR and not attract CGT on any profit you make when you eventually sell it.

Cons

-

You may need to pay rent while you’re out of your home: You can’t buy another home and classify it as your PPOR while taking advantage of the six-year rule. This means you’ll likely need to rent somewhere else to live - unless you have very generous friends and family who will let you stay at their places for up to six years. If you are paying rent to live somewhere else, you will need to weigh up the cost of that against the potential money you’ll save on CGT.

-

Inflexibility: While the six-year rule is a boon if you genuinely have to move out of your home for a short period, if you move out specifically to take advantage of this CGT concession and pocket a bit of rent money, there are a few hurdles you’ll need to overcome. These include meeting the standard requirements in renting out properties and then finding your own place to live.

-

Doesn’t apply to properties held by companies or trusts: The CGT exemption under the six-year rule only applies to properties under the names of individuals, not trusts or company structures.

-

Open to Australian residents only: If you are a non-resident of Australia for tax purposes and own a property in Australia, you are not entitled to claim the six-year CGT exemption when you sell it, even if it was your principal place of residence.

Savings.com.au’s two cents

The six-year rule is a fair concession made by the ATO for homeowners who leave their properties for any reason and choose to rent them out while they aren’t living there. Remember, the rule only applies to one property, your principal place of residence, regardless of how many other properties you own.

If you’re unsure of how CGT exemption applies to your own situation, it’s best to consult an accountant or tax advisor to ensure you meet the criteria and determine the most tax-effective option for your circumstances. It’s also wise to do this before you attempt to take advantage of any rental income or tax exemption schemes of your own design.

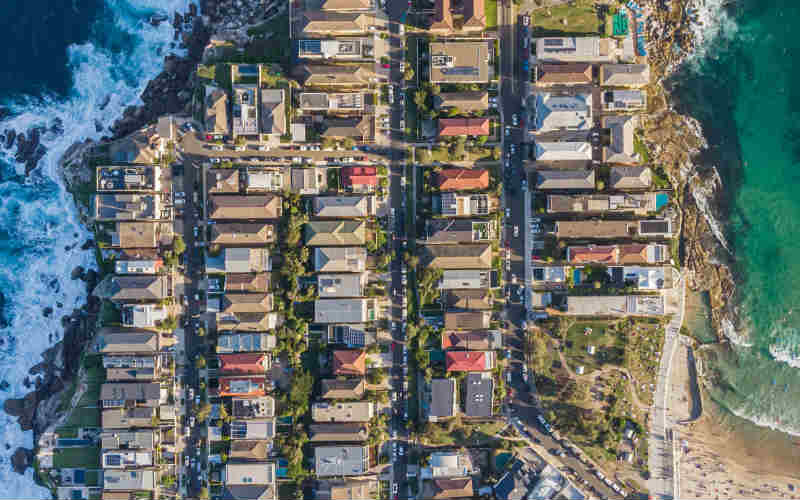

Photo by R Architecture on Unsplash

For personalised tax advice relevant to you, visit the ATO or consult an independent tax advisor.

This article was originally published by Harrison Astbury in March 2022 and was updated in June 2024.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan

Harry O'Sullivan

Harry O'Sullivan