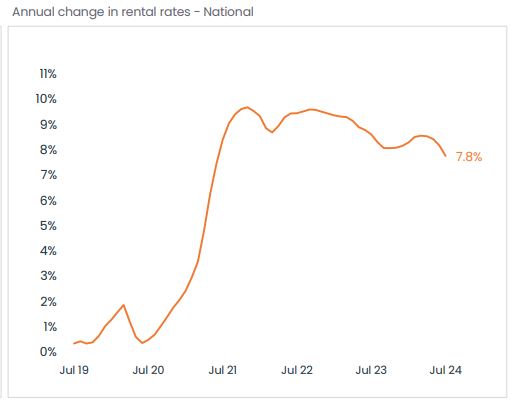

National rents showed a modest 0.1% increase during July and the smallest 12-month change in three years, according to CoreLogic data.

Rents were still up 7.8% in the 12 months to July, but that's down from the most recent peak of 8.6% in April.

CoreLogic Australia economist Kaitlyn Ezzy said the easing in the monthly growth trends marks a stark contrast to the 39.7% surge in rents over the past five years - equating to a $180 jump in weekly rent.

Source: CoreLogic Monthly Housing Chart Pack, August 2024

Tale of eight cities

However, the figures show marked variations between the capital cities.

Rents were up 0.6% in Adelaide last month and 0.3% in Melbourne and Perth.

Perth recorded the strongest annual rental growth of the capitals with an increase of 12.7% followed by regional Western Australia at 10.6%.

In monthly figures, Darwin and Canberra remained flat while the other three capitals - Sydney (-0.1%), Brisbane (-0.1%), and Hobart (-0.3%) - recorded declines.

Ms Ezzy said the variations highlight some cities have hit affordability ceilings with many tenants seeking alternative housing arrangements.

She suggested these included shared housing, relocation to more affordable areas, or leaving the rental market to purchase their own homes.

CBA concurs

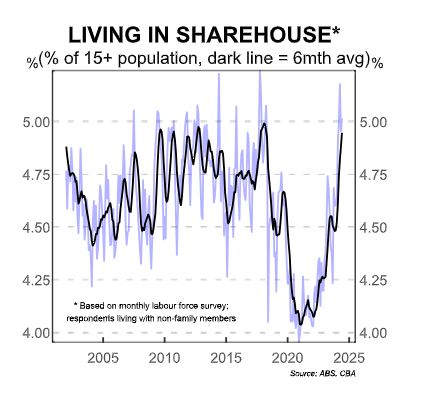

The Commonwealth Bank of Australia has also noted household behaviours are changing as Australians seek to economise on housing costs.

Its data shows there's been a marked increase in adults living in share houses, with fewer living with just their partner.

CBA economist Stephen Wu said the pace of this appears to have ramped up from the start of this year.

He also noted an increase in people living with family members, including extended family.

Still a preference for space

RBA research from 2023 showed the average household size at the start of the pandemic was 2.55 persons; by August 2022 it was 2.48.

This equated to approximately 120,000 extra people needing to find a home, thought to have contributed to the sharp rise in rents.

The share of adult population living alone has also risen sharply, after plummeting in the early stages of the pandemic when people chose companionship over social isolation.

CBA noted 42% of one-person households are aged 65 years or older and the overwhelming majority own their homes outright so have not been impacted by rental costs.

In contrast, the 25-34-year-old age group make up around only 12% of all those living alone.

CBA said while rents were still growing quickly, it noted growth in advertised rents (on newly listed stock) had begun to moderate.

These findings are in line with CoreLogic's although Ms Ezzy warned substantial rent relief seemed unlikely in the short term.

"Lower supply will likely continue to put upward pressure on rents, albeit at a slower pace," she said.

She noted new dwelling approvals and commencements were at historic lows, showing providing new housing won't be a quick fix.

Record migration of more than 650,000 people in the 12 months to September 2023 also added to demand, though this appears to be levelling out.

Homebuyer market on the move

The high cost of renting appeared to be motivating more people with the means to buy their first homes, Ms Ezzy said.

Lending to first-home buyers rose 1.5% to $5.3 billion in June, making up 29% of new owner-occupier finance.

New housing lending up in June, spurred by a 2.7% rise in investor lending.

Ms Ezzy said investors appeared to be more motivated by capital growth rather than rental income.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | LVR | Lump Sum Repayment | Additional Repayments | Split Loan Option | Tags | Features | Link | Compare |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

6.04% p.a. | 6.06% p.a. | $2,408 | Principal & Interest | Variable | $0 | $530 | 90% | Featured 4.6 Star Customer Ratings |

| |||||||||

5.99% p.a. | 5.90% p.a. | $2,396 | Principal & Interest | Variable | $0 | $0 | 80% | Featured Apply In Minutes |

| |||||||||

6.09% p.a. | 6.11% p.a. | $2,421 | Principal & Interest | Variable | $0 | $250 | 60% | Featured Unlimited Redraws |

|

Image by Chris Robert on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!