Data obtained from Pocketbook by Savings.com.au shows a marked increase in spending on liquor, computer goods, cosmetic surgery, and gambling over the past two and a half months compared to the same period last year.

Meanwhile, some of the most common spending haunts - like supermarkets and grocery stores, pubs and bars, clothing retailers and travel agents - have suffered noticeable declines.

Pocketbook's data is based on the 2020 and 2019 spending habits of more than 800,000 users from the first week in October till December 15th.

The table below displays credit cards with some of the lowest interest rates on the market, disregarding any temporary promotional offers.

The biggest winners

By far the biggest surge in spending was seen among computer retailers, which saw a huge 458% spike compared to last year.

Interestingly, spending cosmetic surgery and weight loss treatments were up by 68% and 28% respectively, perhaps indicating Australians are feeling some isolation blues about their appearances (Savings.com.au thinks you're beautiful just the way you are).

Another curious category to see a big increase in spend was caravan dealers, up 60% on the year. This could be a sign Australians are keen to get out and explore our own wonderful country with international travel off the agenda for some time.

[See also: Victorians to receive $200 travel vouchers to kickstart COVID recovery]

With most of Australia confined to their homes for much of the year, it's unsurprising to see bottleshops (+21%) and takeaway meals (+3%) seeing spikes in spending, nor is it surprising to see online retail spending up 10% overall.

And of course, bookmakers had a good year, with Australians flocking to gambling solutions 53% more than last year.

Earlier this year, Alliance of Gambling Reform chief advocate Reverend Tim Costello told Savings.com.au people are gambling more as a way of self-soothing, or with the false hope gambling may solve their problems.

“Pocketbook data has revealed computer retailers are some of the biggest winners this festive period - whether that be friends and family gifting those working from home or consumers treating themselves to an improved home office," Freya Hunter, Head of Partnerships at Pocketbook told Savings.com.au.

"Likewise, spend on cosmetic surgery and weight-loss treatments - which typically see a spike post-festive period - are already well on the rise.

"It’ll be interesting to see what these figures reveal in the New Year, alongside the rise in gambling spend. As 2020 has afforded more people with extra time on their hands, bookmakers have been particularly busy.”

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- A high-interest online savings account with no monthly fees, easy withdrawals and award-winning digital banking

- No withdrawal notice periods or interest rate penalties

- Save up to 10% on eGift cards at over 50 retailers with Macquarie Marketplace

The biggest losers

Some of the biggest casualties of the pandemic were travel agents, clothing retailers, cosmetics and beauty retailers, restaurants, pubs and bars, and grocery stores.

With both international and domestic borders being closed for much of the year, spending on travel agents understandably fell by a massive 71%.

Closer to home, spending on public transport almost halved (down 48%), with around half the country working from home at some point this year.

[See also: Airfares could drop by 35% in a post-coronavirus 2021]

As Australian spending shifted to online marketplaces, spending in clothing retailers and cosmetic and beauty retailers fell by 11% and 20% respectively.

Naturally, spending in pubs and bars as well as restaurants is also down by 24-28% from this time last year, as Australia continues its economic recovery from the tough mid-year period.

“With travel the hardest-hit category this year, this is top of our Christmas wish list to kickstart again in 2021," Ms Hunter said.

"Talks of travel bubbles and COVID vaccines mean we hope it won’t be too long before this becomes a reality."

October - December 2020 spending by category

Food

- The total amount spent in supermarket and grocery stores is down 11% this year

- The total amount spent on takeaway meals is up by 3% this year

- The total amount spent on restaurants is down 28% this year

Drink

- The total amount spent on bottle shops is up 21% this year

- The total amount spent on pubs and bars is down 24% this year

Retailers

- The total amount spent on clothing retailers is down 11% this year

- The total amount spent on computer retailers is up 458% this year

- The total amount spent on online marketplaces is up by 10% this year

- The total amount spent on cosmetics and beauty retailers is down by 20% this year

Transport

- The total amount spent on public transport is down by 48% this year

- The total amount spent on travel agents is down by 71% this year

- The total amount spent on caravan dealers is up by 60% this year

Beauty

- The total amount spent on weight loss treatment is up by 28% this year

- The total amount spent on cosmetic surgery is up by 68% this year

Gambling

- The total amount spent on bookmakers is up by 53% this year

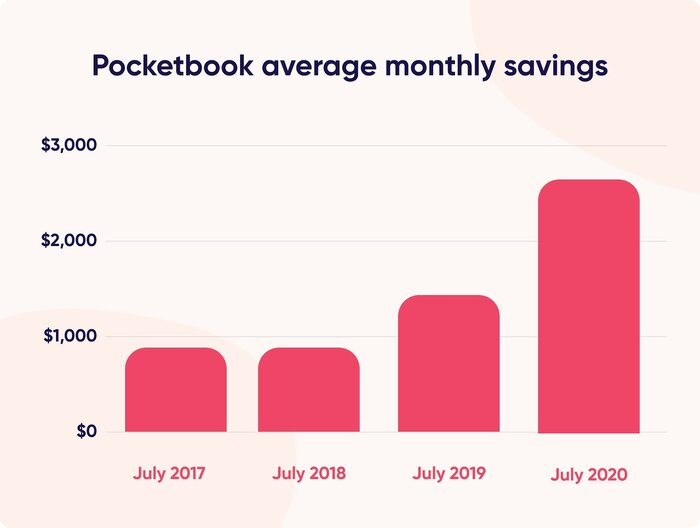

Previous Pocketbook data sent to Savings.com.au showed household savings doubled over COVID and tripled in the past three years, averaging monthly savings of $2,645 in July 2020.

Image source: Pocketbook

Photo by Tamanna Rumee on Unsplash

Brooke Cooper

Brooke Cooper

Alex Brewster

Alex Brewster

William Jolly

William Jolly