That’s a lot of money changing hands. Unsurprisingly, there are a lot of industries that make serious money from this substantial property trade, with mortgage broking being amongst the largest.

Around half of all new home loans written in Australia are through a mortgage broker, a factor which drives the more than $2 billion per year in fees that they as an industry make from the market, according to the Australian Securities and Investments Commission (ASIC).

So what exactly is a mortgage broker, do you need one, or is it better to do it yourself?

What is a mortgage broker?

A mortgage broker is a person or institution who plays matchmaker between property buyers and lenders – i.e. helping borrowers get home loans and helping lenders get customers.

What do mortgage brokers do?

Mortgage brokers work on the borrower’s behalf to arrange the appropriate finance for them to purchase their home, offering advice and guidance throughout the process.

A good broker will:

- Work out what you can afford to borrow

- Understand your property goals and help you achieve them

- Discover options suitable to your circumstance

- Explain various loan products (fixed, variable), what they cost and what features they have (offset, redraw)

Generally, brokers have arrangements with specific lenders to offer particular home loan products to their clients and typically receive commissions from lenders for every loan arrangement.

Brokers are legally required to work in your best interest or risk incurring fines in excess of $1 million.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

Lender Home Loan Interest Rate Comparison Rate* Monthly Repayment Repayment type Rate Type Offset Redraw Ongoing Fees Upfront Fees LVR Lump Sum Repayment Additional Repayments Split Loan Option Tags Features Link Compare

Featured 4.6 Star Customer Ratings

Featured Apply In Minutes

Featured Unlimited Redraws

Do you need a mortgage broker?

Whether you need a mortgage broker is entirely dependent on your financial knowledge, and confidence in navigating the property market. The popularity of brokers speaks to the fundamental need amongst consumers for expert advice and help in navigating the process of getting a home loan.

The alternative to using a mortgage broker is for people to do it themselves, which is sometimes referred to as going ‘direct’.

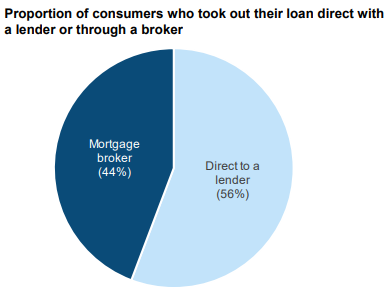

A 2018 ASIC survey of consumers who had taken out a loan in the previous 12 months reported that 56% went direct with a lender while 44% went through a mortgage broker.

Source: ASIC, 2019. Looking for a Mortgage: Consumer experiences and expectations in getting a home loan

The survey also found that 60% of consumers took out a home loan with a lender they had an existing relationship with. This was more likely among consumers who went direct to a lender (69%) consumers who took out their loan through a broker (49%).

Those who stayed with their existing lender consistently indicated that they were disappointed that their lender (typically a bank) did not offer any rewards for an existing relationship. If consumers wanted a lower interest rate on their home loan, they had to ask for it and this was often met with mixed results.

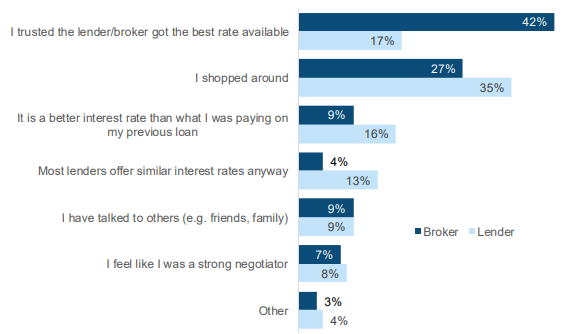

ASIC also found that consumers who used a mortgage broker typically did so expecting that the broker would be able to find them the ‘best’ loan. The ‘best’ loan was defined by consumers as having the lowest interest rate, flexibility and low fees. With regards to the most valued point of the best/lowest interest rate, consumers were far more confident they got the best rate if they went with a broker.

Of consumers who went with through a broker, 42% trusted the broker got them the best rate available, while only 17% of direct consumers trusted the lender gave them the best rate.

Reasons consumers believed they got the best interest rate, by channel

Source: ASIC, 2019. Looking for a Mortgage: Consumer experiences and expectations in getting a home loan

So if you’re unsure about whether to go with a broker or direct, consider questions like these:

- Am I confident in navigating the home loan market?

- Can I better access my desired product by going direct?

- Will I save money by seeing a broker?

- Do I have in-depth knowledge of loan types and features?

Why use a mortgage broker?

Most people have very little idea of what it takes to get a new home loan, so brokers provide convenience by helping to identify a suitable home loan (amongst the thousands available on the market), before guiding you through the process laid out by the chosen lender to ensure that the loan can be settled to meet the needs of you as a customer.

Many people view shopping for a home loan as akin to opening Pandora’s box because there are real risks involved in getting it wrong (costs, timing, etc.).

So there is something of a fear factor that many people have, and essentially they will often look to a mortgage broker to help them navigate the process and provide them with that level of comfort in making the decision.

Evidence would suggest that this guidance is highly sought after and works. The Mortgage and Finance Association of Australia (MFAA) found overall value of new lending facilitated by brokers in the 2021 March quarter was just over $62.2 billion, an increase of $13.2 billion when compared to the $49 billion settled in the March 2020 quarter.

Mortgage Choice CEO Susan Mitchell said the data was a true reflection of customer confidence in Australia’s 17,000 brokers.

“As housing affordability continues to challenge many home buyers, brokers perform a vital service at no cost to the borrower,” Ms Mitchell said.

“This includes a unique combination of choice and price discovery, coupled with the experience and expertise to help guide them through an increasingly complex environment.”

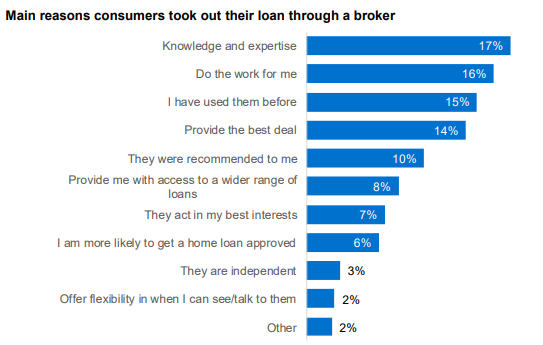

According to ASIC’s research, the top reason given by consumers for taking their loan out through a mortgage broker was ‘knowledge and expertise’. Other popular reasons included ‘do the work for me’, and ‘provide the best deal’.

Source: ASIC, 2019. Looking for a Mortgage: Consumer experiences and expectations in getting a home loan

In theory, a broker should provide a degree of professionalism and empathy in your goals. ASIC’s research affirmed this, with consumers largely expecting brokers to act in their interests.

In an attempt to align legislation with this consumer expectation, the Federal Government announced in August 2019 that a ‘best interests duty’ for mortgage brokers would be introduced by the end of the year.

The cost of using a mortgage broker

As it stands, mortgage brokers are paid by the home loan lender, and not by the consumer getting the home loan.

The revenue model currently used in the mortgage broking industry is one where the home loan lender pays brokers an amount upfront upon settlement of the loan (a percentage of the loan value – usually in the vicinity of 0.6%). So for example, a $500,000 mortgage with a 0.6% commission would see a broker take home $1,500.

Lenders may also pay mortgage brokers a smaller annual payment (also based on the loan amount – usually around 0.1 to 0.15%) while the borrower remains a customer of the lender.

However, many industry pundits (particularly those on the ‘direct side’) point to the pricing of home loans accessed through the mortgage broker channel as being higher than what can be sourced by going direct.

Trying to prove this point is a real challenge, and it is at best a grey area that consumers need to be aware of. Consumers can try and navigate through this grey area by comparing the loans their mortgage broker suggests with other ‘direct’ options available to them in the market (by using free tools like home loan comparison sites).

So this money has to come from somewhere right? Do you end up paying more? Or do the lending institutions consider these upfront and ongoing fees (paid to the brokers) as ‘marketing costs’ required to bring a new customer on board, just as they would view having to pay for an ad in the paper or in Google Adwords?

The only real true test here is for consumers to do their own research on the range of interest rates (and fees) that are available to them through both the direct and mortgage broking channels.

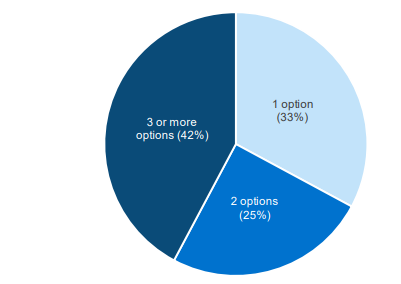

The other potential limitation in using a mortgage broker is that they only have a limited number of home loans (from a limited number of lenders) for you to choose from. ASIC research found 58% of consumers received only one or two loan options from brokers.

Number of loan options provided by brokers

Source: ASIC

That said, in trying to get a home loan direct, many home loan comparison sites do not contain information on the entire market either, in that some only list lenders and specific products that they get paid to refer onto those lenders.

Questions to ask a mortgage broker

1. What are your credentials?

As with any professional, you want to ensure the person you’re dealing with has earned their stripes. Your broker should have a certificate IV in Finance and Mortgage Broking and have an Australian Credit License (ACL), supplied to them by ASIC.

2. How many lenders do you have access too?

To give yourself the best opportunity to get an appropriate home loan for you, you want your broker to have access to at least 20 lenders. If they only deal with two or three, you might as well go direct. Furthermore, investigate each lender; you want a good mix of banks and non-bank institutions.

3. What are your fees and commissions?

Brokers are required to disclose this information to you. Knowing how much each lender pays will give you an idea of any possible conflict of interests, and ensure your broker is definitely working in your best interests.

Why go direct?

Many consumers choose to go direct as they have existing relationships with their bank (or banks) through other products such as savings accounts and credit cards, which can make engaging directly with a home lender a somewhat simpler and less intimidating affair.

Another driver which is seeing a large number of people going direct (for their home loan) but not through their existing banking relationships, is the growth in usage of financial blogs and home loan comparison sites. Their utility, free from what some think as conflicted broker advice, is a great way to maintain complete control of the process. To do this, you have to have a fair degree of confidence in your ability to be able to recognise quality information, information which is complete and can be, in your own mind, trusted.

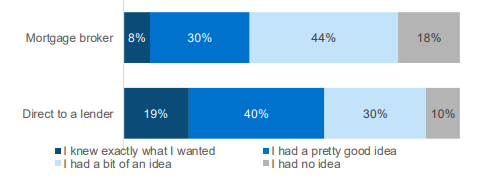

ASIC found that of consumers who took out their loan direct, 59% ‘knew exactly’ or had a ‘pretty good idea’ of the home loan they wanted, compared to 38% of consumers who used a broker.

Consumer understanding of the home loan they wanted, by channel

Source: ASIC

When using a comparison website, it is critical to understand just how much of the market (eg. lenders and their specific home loan products) is actually listed on the site. Secondly, understand that many of them are simply ‘referrers’ in that after you have used them to research the market and create a ‘shortlist’ of home loan product options, when you click on a particular option, you’ll simply be referred through to that specific lender’s sales teams to begin the process.

Again, this option is going to suit the type of person who has not only the time to do this but also the confidence and the need for direct control over the process.

Outside of the financial blog and comparison site sector, there has also been a rise in the number of online lenders in the marketplace, who have built smart-but-easily-navigated technology systems that make the process of getting a new home loan both simple and easy to execute.

Just to clarify, whilst they are called ‘online’ lenders, the good ones will actually advertise on their website that they have a phone number you can call in on, to speak with their team of lending specialists (so it’s not all ‘automated’ and you can actually talk to a human being).

Frequently asked questions

1. Can you have two mortgage brokers?

Using multiple mortgage brokers can be possible, although it might not be a good idea, particularly if they're both submitting applications on your behalf. Using more than one broker may sound like a good idea in theory because it could give you a wider variety of loans to choose from, but in practice, it can make matters more complicated.

2. Is a mortgage broker worth it?

There's generally no direct cost for using a mortgage broker, so their worthiness ultimately depends on the quality of the loan they help you secure. If they help you into a suitable loan with one of the lowest interest rates for what you're after, then great. But if you could've qualified for a similar loan with an interest rate that's 0.5% points cheaper than the one the broker recommended, the broker may be costing you tens of thousands in extra interest charges over the life of the loan. That's why it can pay to do some of your own research to check out some of the lowest rate home loans on the market so that you have a better idea of whether the broker has found you a good deal or not.

3. How do I find a good mortgage broker?

To find a good mortgage broker, you could try seeking advice from family and friends who have used brokers before and research their recommendations. You could also check out brokers' reviews on Google, but as with anything in the murky world of online reviews, take these with a pinch of salt.

4. Do mortgage brokers assume risk?

Even if the borrower applies for a loan through a broker, the lender (not the broker) still takes on the financial risk of the borrower defaulting on the debt. Brokers are generally paid a commission upfront by the lender, so they may have a low incentive to consider a borrower's risk of mortgage delinquency. However, it is in a broker's interests to maintain good business relationships with a range of lenders by consistently referring good quality borrowers to them, so in that sense, they do somewhat assume a degree of risk.

5. Can a mortgage broker help with bad credit?

If you have bad credit, a mortgage broker may be able to find specialist lenders who may be willing to approve you for a home loan. They could also strengthen your application to give the best possible chance of approval.

6. Are mortgage brokers regulated?

Mortgage brokers must hold either an Australian Credit License (ACL) or be a credit representative of a licensee (aggregator). While mortgage brokers are not regulated by the Australian Prudential Regulation Authority (APRA), APRA oversees the lending panel.

7. Why can mortgage brokers get better rates?

Mortgage brokers often work closely with lenders, so they may have access to insider knowledge, deals and rates the average home buyer doesn't. Mortgage brokers also often have strong negotiating power and may help you get a lower interest rate on your mortgage because the banks want their business.

Savings.com.au’s two cents

The decision to go with a mortgage broker or not in your quest to get a home loan is probably more about your own individual circumstances than it is the specific merits of using them vs. going direct and doing the work yourself.

Brokers not only provide you with convenience and control, but also an ongoing contact to touch base with even after you have settled on your new loan and home.

This is because they are paid an annual fee by the lender whilst you have that loan, and hence they have a vested interest. Additionally, if you decide at some point in the future that you want to refinance with another lender to get a better deal, the broker could be able to help you through this process as well.

Alternatively, doing it all yourself is also a viable option when you’re looking for a home loan. Probably the greatest factors that should determine your choice of which resources to use here are around how much time you have (to do the research, engage with lender, etc.) and how confident you are.

Many people who are time poor but are somewhat sceptical about the limited range a broker may have to choose from will do their own research on the market ‘direct’ (eg. using a financial blog/comparison site) and then provide the broker with a list of product options that they have to try and better.

This way, the person knows (if they’re confident in their own researching abilities) that they are getting a good product and price (interest rate), and that if the broker can get a similar deal through their own network of home lenders, they also get the convenience and comfort of knowing that the process is being managed by the broker.

Of course, picking the right home loan with a great interest rate and other product features that you may be able to utilise (e.g. redraw, offset account, etc.) over the life of your loan is going to put you in the box seat to be able to save money. And that is what it’s all about.

Article originally published by David Lammey, 2019. Last updated by Aaron Bell March 21, 2022.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan

Brooke Cooper

Brooke Cooper

Denise Raward

Denise Raward