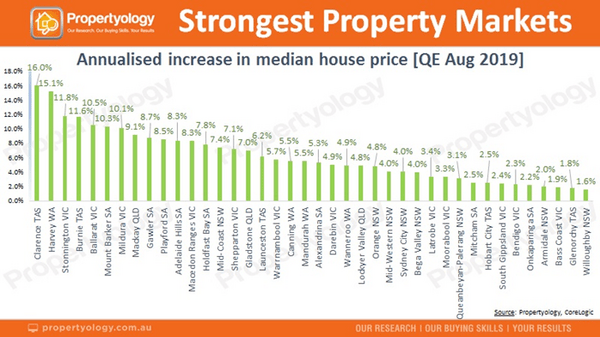

Property market analyst Propertyology has found the area with the strongest growth in recent months was the Greater-Hobart city council of Clarence, which has run an annualised growth of 16%.

Propertyology analysed the change in median house price of every municipality in Australia over the three months to 31 August 2019, and Clarence’s median house price increased by 4% in that time.

Tasmania in general is producing “stellar” results, with Glenorchy in Hobart producing 48% growth over the past five years.

According to Propertyology Head of Research Simon Pressley, positivity in Tasmania extends beyond the state’s capital.

“The port city of Burnie has produced 19 per cent growth over the last 3 years and appears to be gaining speed,” Mr Pressley said.

“Beautiful Launceston is also ranked inside the current 20 strongest property markets in Australia.”

Hobart’s median house price has grown by 2.5% (annualised).

Photo by Matt Chen on Unsplash

The second-highest property market in terms of annualised growth in median property prices is Harvey in Western Australia (15.1%), while Melbourne’s inner-eastern municipality of Stonnington is third, currently running at the annualised rate of 11.8%.

“Perth itself has taken longer to recover than we first anticipated but there are some signs of it starting to rediscover its mojo,” said Mr Pressley.

“Real estate in regional Victoria continues to be very strong. Ballarat and Mildura are both enjoying double-digit growth and Macedon Ranges continue their strong run.

“Bendigo, Shepparton and Warrnambool are emerging markets.”

In south-east Queensland, Lockyer Valley (4.8%) is the strongest market, while Orange (4.8%), Bega Valley, Mid-Coast and Armidale were among the strongest markets in New South Wales.

Mount Barker (10.3%), Gawler (8.7%) and Adelaide Hills (8.3%) are the highest-placed in South Australia.

Source: Propertyology, CoreLogic

These are some very different results than those seen in similar research Propertology conducted in May.

Over the three months to February 2019, Propertyology found the best performing property hotspot was Whyalla, South Australia’s third-largest city, with an annualised median house price growth of 13.3%.

According to Mr Pressley, the three recent interest rate reductions by the Reserve Bank is starting to have the desired effect on property buyers.

“Property buyers are recognising that the all-time low interest rates are a one in a lifetime opportunity for property ownership,” he said.

“Large parts of Australia that haven’t produced price growth for quite some time have actually had solid property market fundamentals for a while.

“Policy settings from RBA and APRA in the back half of this year will provide the stimulation required for 2020 to produce some outstanding results.”

For would-be property investors, Mr Pressley says local conditions such as local supply volumes, job numbers and local confidence always have a greater influence on property markets than national factors.

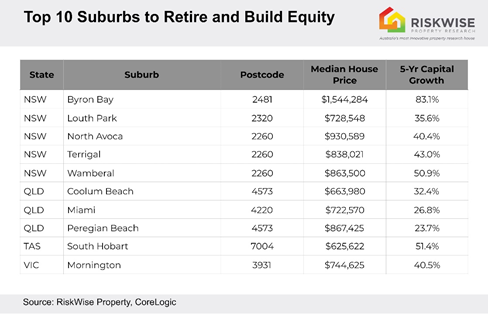

Top 10 suburbs to retire in

RiskWise Property Research has identified the top 10 suburbs it deems to be good places to retire on based on three important factors:

- Lifestyle

- Relative affordability, and

- Building equity

These 10 suburbs are as follows:

According to RiskWise CEO Doron Peleg, these three factors are essential when choosing a property to retire in.

“Lifestyle varies from person to person. Some are looking for a seachange, others a treechange and there are many who want to be within easy distance of family,” Mr Peleg said.

“When it comes to ‘relative affordability’, that too can depend on the individual purchaser. For example, Bryon Bay is relatively affordable for a well-off downsizer from Sydney and Melbourne, but not necessarily for those moving from other areas.”

“And, of course, building wealth or equity over time is just as important as the two other factors, and RiskWise has identified areas which have clearly demonstrated where this is possible.

“In other words, they offer good lifestyle options, value for money and solid long-term capital growth projections.”

Mr Peleg said some of the areas listed above have shown great resilience in the face of a significant recent downturn in property prices.

“These areas will most likely reach a new peak or price level in about 12 months and will have fully recovered from the downturn.”

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Emma Duffy

Emma Duffy

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan

Alex Brewster

Alex Brewster