Lol no.

Payday loans or cash loans: what to know

While you can technically borrow $2,000 in an hour through some specialty lenders (without even getting out of bed, I might add), that money is likely to come with a ton strings attached to it - namely the exorbitant fees that many people who take out these loans aren’t aware of.

Such loans can be referred to as ‘fast loans’, ‘cash loans’ or ‘small amount loans’, but are widely known as ‘payday loans’.

Many providers of these loans have a tendency to market themselves as carefree lenders - there to give you some sweet magic cash for times when you’re broke AF….

You might’ve heard adverts along the lines of: “Don’t have enough money for groceries? Can’t pay your rent this week? Just received an electricity bill that you absolutely don’t have the money for? Pfffft. Just apply for a fast loan and move on!”

Now you don’t need to be a financial expert to recognise that taking out a loan to help you pay for things like groceries or electricity bills is not good for your finances - in fact, one particular small loan provider in Australia was recently forced to pull one of its TV adverts off the airwaves because the advert suggested people can take out a fast loan to pay their utility bill.

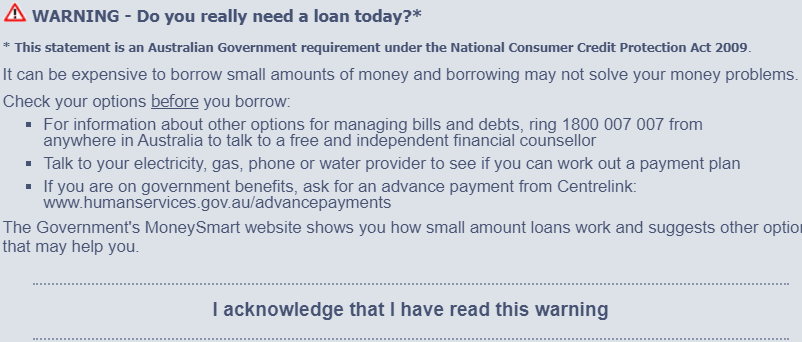

Payday loans are considered so dangerous that all payday lenders are actually forced under Australian consumer law to display this warning message to potential applicants:

Yet there are still many people who resort to taking out payday loans.

That’s usually because the people who use payday loans are often in a tough financial situation to begin with. They’re commonly used to fund emergencies, the gap in people’s budgets, or perhaps most worryingly, to cover other debt repayments. It’s not a coincidence that some payday loan companies target desperate, financially vulnerable people - hence the term ‘predatory lenders’.

For vulnerable people, a payday loan can seem like their only option. A quick fix. But the people who take out payday loans can find themselves trapped in an ongoing debt cycle. One payday loan can create the need for a second, and then a third…

Here’s what you need to know about payday loans.

What is a payday loan?

Payday loans allow you to borrow small amounts of money (usually up to $2,000 but some payday lenders allow up to $5,000) that must be repaid within a period of 16 days to 12 months.

Repayments are often made in line with your pay (such as fortnightly) either as a direct debit from your bank account or as a deduction from your pay.

Payday loan eligibility

Compared to other loan providers, payday lenders generally have less stringent lending criteria. Applying for a payday loan is often a fairly quick process that can be done online.

Many lenders have different criteria but applicants generally need to meet the following minimum criteria:

- Be over the age of 18

- Be an Australian citizen or permanent resident

- Receive a regular income (even if that income is Centrelink benefits)

Applicants will often need to supply the lender with 90 days' worth of bank statements, identification, employment details, copies of bills or Centrelink receipts, and details about income such as how much they earn each week.

How do payday loans work?

Once the lender has approved your payday loan application, the funds could be in your bank account in under an hour.

Then it’s a matter of repaying the loan. Many payday lenders will allow customers to select their own loan term but the repayments are generally scheduled to come out in line with when you receive your pay.

Many lenders will set up a direct debit from their bank account for that day and send SMS reminders (however not all payday lenders do this).

If there aren’t enough funds in the bank account to cover repayments, a failed direct debit will result in a charge by the lender and the bank. Which brings us to…

Payday loans rates & fees

Payday lenders aren’t allowed to charge interest, so they make up for it by charging fees instead. According to the Australian Securities and Investment Commission (ASIC), payday lenders are only allowed to charge the following for loans under $2,000 with terms of between 16 days and one year:

- A one-off establishment fee of up to 20% of the amount loaned

- A monthly account keeping fee of up to 4% of the amount loaned

- A government fee or charge

- Default fees or charges - up to 200% of the total loan amount

- Enforcement expenses (if the lender has to take you to court for failing to repay the loan). There is no limit on these expenses

If that sounds expensive it’s because it is. The reason payday loans are one of the most expensive forms of finance is because they accept applicants most lenders would reject.

People like Deb T, for example.

Deb is drowning in $10,000 of credit card debt and struggling to keep up with her repayments, so she decides to take out a $600 payday loan to ease a bit of the pain. Within minutes she’s approved and the $600 is in her bank account. So $600 doesn’t sound like much, but there’s also a 20% loan establishment fee and a 4% monthly fee. For those of you playing along at home, that $600 loan is now a $744 loan.

Deb quickly realised what she had gotten herself into when her first payment notice arrived and she couldn’t cover it because she’d already spent her Centrelink benefits for that week on rent, groceries and fuel. Deb started falling behind on her repayments and a few months later, her $600 loan had blown out to $1,100. Then the debt collectors came calling. Deb eventually managed to change her repayment plan to a lower fortnightly amount of $50 but that meant stretching out the length of the loan and racking up several more months' worth of fees.

In a bid to try and play catch up and cover the repayments of the first payday loan, Deb took out a second loan. Fast forward to today and yep, she’s still paying off both loans. Deb’s story is a clear example of how the payday loan debt trap works. Because payday loans are for such short periods with unaffordably high repayments, many people find themselves taking out additional payday loans to try and keep up. In fact, over a five-year period, around 15% of payday borrowers will fall into a debt spiral, according to data from Digital Finance Analytics (DFA).

A 2019 report by Stop The Debt Trap Alliance found that because payday loans are usually repaid via direct debit timed to debit a person’s account when their income arrives, people can find themselves caught short.

“The repayments are often a significant portion of a person’s income, leaving them with little left over to pay for essential expenses like food, bills and rent. This means the person with the payday loan may be caught short when a loan payment is due, and they have little choice but to take out an additional payday loan to make ends meet,” the report said.

“The result: they are soon trapped in a debt spiral and are struggling to make loan repayments.”

Are payday loans bad for credit?

As with any form of debt, a payday loan is treated like any other liability during a home loan application. When assessing an application for a line of credit, lenders will look over the applicant’s credit history to see what their financial habits are like and determine their risk as a borrower. Assessment criteria will vary between lenders but many will consider a number of factors like the number of credit inquiries you’ve made (loan inquiries), credit limits, the amount of active credit accounts you have, and any defaults. It’s important to note that buy now pay later services are considered lines of credit.

How a bank will consider an applicant who has used a payday loan will depend on their credit history as a whole.

Savings.com.au asked the big four banks how they consider borrowers who have taken out a payday loan when applying for other lines of credit like a home loan.

An ANZ spokesperson told Savings.com.au they would consider a borrower who had taken out a payday loan as a risk, but that “each applicant’s particular circumstances will dictate to what extent”.

It was a similar sentiment echoed by NAB and Westpac. A NAB spokesperson told Savings.com.au they “consider all lending applications on a case-by-case basis”.

“Serviceability is assessed on a number of factors, to ensure customers can make repayments both now and into the future,” NAB said.

What if you need money before payday?

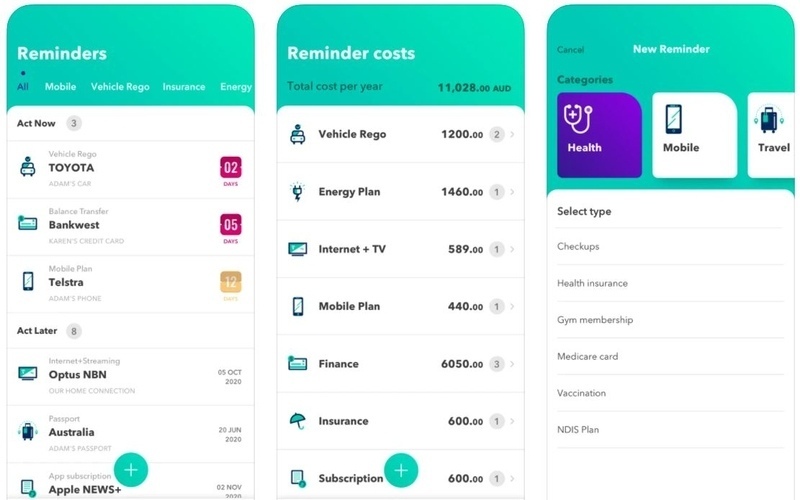

Payday loans can present themselves as a ‘stop-gap’ solution but it’s best to avoid using one at all if you can. If you’re strapped for cash, there are alternatives.

-

Negotiate with your utility provider: If you’re having trouble paying your bills, most providers have hardship staff who can help you work out an alternative payment plan, such as paying off your bill in smaller instalments.

-

Centrelink advance payment: If you’re eligible for Centrelink benefits, you may be able to get an advance payment on your benefits and you won’t be charged interest.

-

Get a no or low-interest loan: If you’re on a low income, you may be eligible for a no or low-interest loan to help pay for those essentials or an emergency.

What if you can’t afford to repay a payday loan?

If you think you won’t be able to make your next repayment, the first thing you should do is contact your lender and let them know. Some lenders have financial hardship departments who can help you out in moments like these and delay the next direct debit repayment. That way, your bank and the lender can’t charge you for a failed payment.

After you’ve done that, it’s best to take a look at your budget and set enough money aside to make sure you will have enough in your account to make the next repayment. But if you still don’t think you’ll be able to cover your repayments, you should get in touch with your lender again to discuss your options.

The worst thing you could do is to ignore the repayment or take out another payday loan as both options will only leave you even further in debt.

Frequently asked questions

1. How to remove payday loans from credit report?

Unfortunately, you can’t remove any information on your credit report that is correct. But the good thing is that all applications for things like credit cards, payday loans, home loans, car loans etc. only stay on your credit report for five years.

In the meantime, avoid credit repair companies who say they can wipe payday loans off your credit report - they can’t. They’re also extremely unlikely to be able to repair your credit score but they’ll charge you through the roof for it anyway. Instead, work on building good money habits yourself (this is free!) or consider speaking with a free financial counsellor who can help you get back on track.

2. What are some of the payday lenders in Australia?

Nimble and Speckle are some of the more prominent payday lenders in Australia, while others include MoneyMe, Sunshine Short Term Loans, Safe Financial Small Loan, Credit24 Short Term Loan, Fair Go Finance Small Loan and Ferratum Cash Loans.

3. Do payday loans show on a credit report in Australia?

Yes. Payday loans will show up on your credit report as they are a line of credit.

Payday loans are usually listed as a ‘personal loan’ in your credit report and will include information about the amount of money borrowed as well as any defaults (missed payments).

4. Can I get a payday loan on benefits?

Every payday lender has its own rules about lending to people who are not currently employed or receive benefits. There are some payday lenders who will lend to people on benefits. Check directly with the lender to find out what their eligibility rules are.

An alternative to taking out a payday loan is to apply for an advance payment of your benefit. Most people who receive Centrelink can apply for this and there are no fees or interest charges.

5. How many payday loans can I get at once?

This will depend on the lender you are applying to but yes, you can take out multiple payday loans at once.

However, you may find the screening process is more thorough the second time around because lenders are required by the Australian Securities and Investments Commission (ASIC) to put further checks and balances in place for those applying for multiple loans, as it’s a sign they’re under severe financial stress and may have trouble paying the money back.

It is strongly recommended that you reconsider taking out too many payday loans at once because doing so can quickly lead to your debt spiralling out of control.

Savings.com.au’s two cents

Before taking out any loan or financial product, it’s important to understand how it works. The same is true for payday loans.

Payday loans could be helpful in those last-resort situations, but only when they’re used responsibly and paid back on time. That’s why borrowers should sit down and work out the true cost of the loan, and whether it will ultimately help, or simply delay existing problems.

Borrowers often forget to factor in the fees charged by payday lenders in addition to the repayments. While some of these fees may not seem like that big of a deal in a moment when you’re hard up for cash, they can quickly blow out of control and put you in an even worse financial situation than you were in before.

That’s why at Savings.com.au we often wax lyrical about the importance of having emergency savings. Having a stash of cash only to be used for those dire situations could get you out of trouble. You’ll thank yourself later.

Hanan Dervisevic

Hanan Dervisevic

William Jolly

William Jolly