A cynic would say that these groups want you to lose interest so they can go about their business, with your money, without interference. However interest is a very simple thing to grasp when broken down, and being misinformed on the topic may compound your financial misery.

What is interest?

It might seem obvious but it’s important to grasp the concept before diving into the types. The concept constantly floats around media and our conversations and often we don’t have a clear idea of its actual definition.

Interest is the cost of using somebody else’s money and works in two ways. When you borrow money, you pay interest. When you lend money, you earn interest.

Interest earned

So if you deposit money into a bank, interest is what you earn for keeping it there, which will be a percentage of the deposit. The bank wants to encourage you to keep your money in your account, rather than spend it, so they can use it to invest and are frequently chopping and changing rates to encourage you to bank with them.

Interest paid

If you take a loan out or use a credit card, interest is a percentage of your balance that you pay to use those services. Obviously, these companies aren’t going to give you their money to use willy nilly without a benefit for them, so they charge you interest to make a profit. A home loan is probably the most prominent example of interest you pay, as the amount will often be in the hundreds of thousands.

Interest is shown as a percentage rate, generally as an annual figure. For example 6% p.a (per annum). This means over the course of one year, you’ll either earn or pay 6% in interest.

Types of interest

There are two main types of interest, that apply to the majority of people; simple and compound interest. So how do they work, and what’s the difference?

What is simple interest?

Simple interest, also known as nominal interest, is interest that can only be earned on the money you have deposited into an account (principal), not on the money you’re earning (interest).

What is the formula for simple interest?

The total cost of a simple interest loan can be calculated using the following formula:

A = P (1 + Rt)

| Formula | Explanation |

|---|---|

| A | the total accrued amount (principal + interest) |

| P | principal amount |

| I | interest amount |

| R | rate of interest (as a percentage or decimal) |

| t | time period involved (annually/monthly) |

Now I know, all those suppressed high school maths lessons are flooding back as soon as we’ve seen an equation but we’ll break it down simply.

Let’s take the example of Anna. She’s just graduated her teaching degree at uni and now needs a car to get to work. She takes out a $10,000 personal loan to pay for the car. The bank is (generously) offering her a 5% p.a. interest rate and she’s going to take three years to pay off the loan.

In the example:

- A = Total cost of the loan = P + I

- P = $10,000 loan

- I =?

- R= 0.05 (converted from a percentage to a decimal)

- t = 3 years

So A = $10,000 (1 + 0.05 x 3)

A = $10,000 x (1.15)

A = $11,500

So Anna would have to repay $11,500 in total. If we wanted to just calculate how much interest she was paying, the formula would be:

I = A – P

I = $11,500 – $10,000

I = $1,500

Just like in the example above, simple interest is commonly used for loans including home loans, car loans and personal loans. Term deposits often also use simple interest, while savings accounts tend to use compound interest.

Want to earn a fixed interest rate on your cash? The table below features term deposits with some of the highest interest rates on the market for a six-month term.

Provider | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| At Maturity, Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 6 months

| |||||||||||||

Term Deposit - 6 months

| |||||||||||||

| Annually, At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($1000-$500001) - 6 months | |||||||||||||

| At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | 8 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Online Term Deposit - 6 months | |||||||||||||

| Annually, Semi-Annually, At Maturity, Monthly | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 6 months | |||||||||||||

| At Maturity, Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 25000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($25k-$5m) - 6 months | |||||||||||||

| At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Investment ($100k-$200k) - 6 months | |||||||||||||

| At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 500 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($500 - $1mn) - 6 months | |||||||||||||

| At Maturity, Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($5k-$25k) - 6 months | |||||||||||||

| Annually, At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($1000+) - 6 months | |||||||||||||

| Annually, At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($5000-$999999) - 6 months | |||||||||||||

| At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($5k-$500k) - 6 months | |||||||||||||

| Annually, At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 250000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($250k+) - 6 Months | |||||||||||||

| At Maturity, Monthly | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 25000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit - 6 months | |||||||||||||

| Annually, At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit (> $1000) - 6 months | |||||||||||||

| At Maturity, Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

TDs Premier Investment ($5k - $250k) - 6 months | |||||||||||||

| At Maturity, Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($1000+) - 6 months | |||||||||||||

| At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit - 6 months | |||||||||||||

| At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | 7 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Savings ($1000-$500000) - 6 months | |||||||||||||

| Annually, At Maturity, Monthly | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 10000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit ($10000+) - 6 months | |||||||||||||

| Annually, At Maturity | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | 31 | $product[$field["value"]] | $product[$field["value"]] | More details | |||||

Term Deposit - 6 months | |||||||||||||

- Guaranteed rate of return

- Manage your term deposit online

- Choose your own term - Options range from one month to five years

What is compound interest?

You’ve gone through the primary school of simple interest – now the day is finally here, you’re ready for the secondary school that is compound interest.

Warren Buffet was quoted in 2010 saying, “My wealth has come from a combination of living in America, some lucky genes, and compound interest.” Albert Einstein also allegedly said compound interest is the eighth wonder of the world, but it’s unclear if this is actually something he said – it might just be one of those internet rumours that took off.

Whether Einstein actually said this or not, there’s no denying compound interest’s power. Compound interest is interest paid on the initial principal, as well as the accumulated interest on money that you’ve borrowed or invested. You earn interest on your deposit and interest on your interest. It’s the hygienic financial version of double-dipping.

What is the formula of compound interest?

Compound interest is calculated using the following formula:

A = P (1 + r) (n)

We’re using the same abbreviations as before, except A is for final balance (deposit plus interest earnings), P is for the deposited amount and the added ‘n’ is for the number of times that interest is compounded.

Let’s revisit Anna. After imparting her wisdom on the next generation for a bit, she’s managed to save $5,000 and has decided to invest it for some extra income. She’s investing it into an account which compounds monthly (which is one of the most common) at a very generous 5% p.a. and won’t make any additional payments, for a three-year period (36 months). First, however, we need to divide the annual interest rate by 12, to get the monthly rate, which comes to 0.00416.

A = $5000 (1.00416)36

A = $5000 x 1.1611

A = $5,805

If we break that figure down further, Anna earned $255.81 interest in her first year, $268.90 in the second and $282.65 in the third and final.

If it got too complex for you and you feel like switching off, there are heaps of online calculators which do this for you and can break down the figures into graphs.

Which interest reigns supreme when it comes to savings?

You’ve watched all the movies, waited years, read every fan theory but now it’s finally here. Avengers: Endgame, Batman v Superman, Sharknado 6, these franchises all pale in comparison to simple v compound interest.

But also if you’ve been paying attention, this is a bigger mismatch than when the Socceroos played American Samoa in a 2002 FIFA World Cup qualifier, winning a world record 31-0.

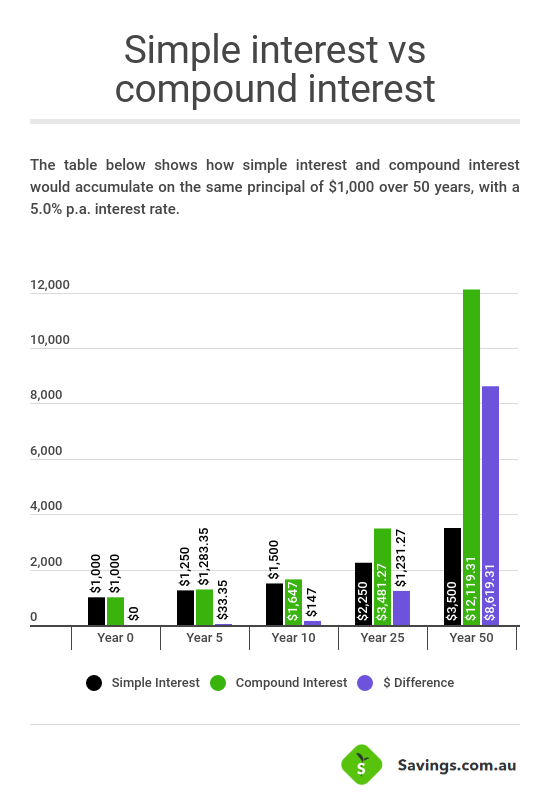

Simple interest can be seen as the domino effect while compound interest is more of a snowball. Simple interest will continue to tick over, each year yielding the same interest again and again. Compound interest will yield an amount of interest that only increases the longer it’s left to its own devices, a rolling snowball, swelling in size over time.

As you can see in the graph above, compound interest dwarves simple interest in its profits. It’s a bit of a no brainer that if given the decision to pick between the two for interest you earn, you would side with compound. But for the interest you pay, simple interest is probably more beneficial.

Simple interest is simple by name and simple by nature. However, while compound interest is a lender’s best friend, you’re certainly not always going to be the lender. A credit card is one such product that will use compound interest to maximise its profits and your stresses.

Savings.com.au’s two cents

Interest can definitely be a dry topic but it’s such an integral pillar of our economy that being uneducated on it leaves you open to massive financial stress. On the opposite end of the spectrum, having an understanding of the topic and communicating with your bank can give you a monetary leg up, with very little effort required.

Realistically, there are few times where you’ll interact with simple interest, but when it comes to the business behemoth that is compound interest, stand your ground and take the bull by the horns.

No matter how small the amount, invest now, because although time is a man-made construct, it’s also of the essence. Use this page as a refresher, and ensure you’re on the right side of compound interest as much as possible.

Denise Raward

Denise Raward

Emma Duffy

Emma Duffy