If you’re keen to expand your financial horizons beyond savings accounts and term deposits, you might have thought about becoming an investor. It can be daunting to hear people talk about things like ‘short selling' and ‘bear markets' if you don’t know what they’re on about, but investing doesn’t always need to be complicated. Micro-investing apps can be a simple way to get started.

What is microinvesting?

Micro-investing allows you to invest in financial assets like funds or stocks with only a small amount of money, sometimes just a few dollars. Micro-investing platforms are almost always online and are usually smartphone apps. You can often buy fractionally so you can get started even if you can’t afford full units. For example, some apps allow you to buy $0.50 worth of Rio Tinto stock, the share price of which trends close to $120.

Some platforms feature spare change investing, which automatically round up smaller purchases to the nearest dollar and invests the cents (e.g. you might buy a coffee for $4.50 - in this case the app would automatically invest 50 cents).

The idea behind micro-investing is to make investing easier and more accessible for beginners. Think of it as training wheels for new investors.

See also: Beginner’s guide to investing

What micro-investing platforms are available in Australia?

-

Raiz Invest

-

Spaceship Voyager

-

CommSec Pocket

-

Sharesies

-

Blossom

-

Pearler

-

Stake

- Douugh

Raiz Invest

Raiz, one of the first micro-investing platforms in Australia, is also the most well-known, with a cult-like following from millennials and Gen Zs.

Raiz is a mobile app that allows users to automatically invest the spare change from their purchases into a selected mix of exchange-traded funds (ETFs). Users can also choose to make lump sum deposits or set up recurring payments into their investment portfolio.

Raiz users can choose from the following different diversified portfolios:

-

Standard (Conservative)

-

Standard (Moderately Conservative)

-

Standard (Moderate)

-

Standard (Moderately Aggresive)

-

Standard (Aggresive)

-

Emerald (the portfolio sticks to ‘socially responsible’ investments)

-

Property (30% of the investment is in the Raiz property fund)

-

Sapphire (includes a 5% allocation to bitcoin)

-

Plus (allows customers to fully customise their portfolio, incorporating different elements from the other options as well as the ability to fractionally invest in top 50 ASX stocks).

You can withdraw your money from Raiz at any time for free, and there are no minimum account balances.

Raiz charges a monthly $4.50 maintenance fee for the Standard, Emerald, Sapphire and Property portfolios. Standard and Emerald have a 0.275% annual charge on balances over $20,000, which applies to Property and Sapphire regardless of your balance. Plus Portfolios have a $5.50 fee, and a 0.275% annual charge for accounts over $25,000.

Spaceship Voyager

Spaceship allows users to deposit lump sums or set up recurring weekly, fortnightly, or monthly payments into three different portfolios using an app. These portfolios include:

-

Spaceship Universe (a portfolio of ‘world changing’ companies including the likes of Microsoft, Spotify and Tesla)

-

Spaceship Origin (a portfolio of companies making a ‘positive impact’ on people and the planet including Atlassian, Shopify and First Solar)

-

Spaceship Earth (a portfolio of established, top 200 global and Australian companies including Apple, Berkshire Hathaway and Amazon)

Users can track the progress of their portfolio through the mobile app and link their portfolio to an external bank account to deposit and withdraw money.

Spaceship charge customers a monthly fee of $2. This fee is applied when you have a single Spaceship Voyager portfolio with a balance of $100 or more, with no additional fees for extra portfolios. There is an additional management charge calculated based on customers balance in each portfolio.

-

0.50% p.a for Spaceship Universe

-

0.50% p.a for Spaceship Earth

-

0.15% p.a for Spaceship Origin

Spaceship does not charge any brokerage fees, withdrawal fees or exit fees, and investors can withdraw their money from Spaceship at any time.

CommSec Pocket

CommSec Pocket is a micro-investing platform offered by the Commonwealth Bank of Australia, launched back in 2019. CommSec Pocket is a little different to the micro-investing apps outlined above as customers require a linked Commonwealth Bank transaction account to deposit and withdraw funds.

CommSec Pocket has seven different ETFs available for customers to invest in, based on different ‘themes’:

-

Aussie Top 200 (IOZ)

-

Aussie Dividends (SYI)

-

Global 100 (I00)

-

Emerging Markets (IEM)

-

Health Wise (IXJ)

-

Sustainability Leaders (ETHI)

-

Tech Savvy (NDQ)

-

Global Diversified (DHHF)

-

Aussie Sustainability (GRNV)

-

Aussie Corporate bonds (CRED)

Commsec Pocket investors have to make a minimum trade of $50, which can then be invested either as a lump sum or via recurring fortnightly or monthly payments. It charges $2 per trade for investments under $1,000 and 0.2% of the trade value for amounts above $1,000, so if you’re investing the minimum of $50, you’re being charged 4% on the trade.

CommSec Pocket also charges a late settlement fee. Cash is withdrawn from your account two days after your trade has been completed, rather than straight away. If there aren’t sufficient funds when CBA withdraws this money, you will be charged a $10 late settlement fee.

It’s sister app CommSec has a minimum investment amount of $500 and brokerage fees starting from $5, so CommSec Pocket is a more affordable alternative.

Sharesies

Founded in New Zealand, Sharesies is one of the newer kids on the block in the micro-investing space, but works a bit differently from the other apps. For starters, Sharesies doesn’t have different portfolios like Raiz or Spaceship. Instead, Sharesies allows you to invest in individual companies all over the world from a variety of stock markets, including:

-

Australian Securities Exchange (ASX)

-

New Zealand Exchange (NZX)

-

New York Stock Exchange (NYSE)

-

Nasdaq

-

Chicago Board Options Exchange (CBOE)

This means users can invest in Australian companies like Coles, Commonwealth Bank, BHP Billiton, as well household names like Apple, Tesla, Amazon, Disney or Coca-Cola in overseas markets. Sharesies also gives the option of investing in ETFs containing a number of companies or assets with a single trade.

Sharesies updated its fees from 24 January 2023, with the transaction fee increasing to 1.9% on the amount invested, up to a capped amount (capped at $5USD for US shares, $6AUD for Aussie shares and $25NZD for NZ shares). There are also monthly subscription options that cover trades up to a certain amount.

|

Monthly fee |

What you get |

|---|---|

|

$5 |

Transaction fees covered up to $500 AUD of buy and sell orders, and $1,000 AUD of auto-invest orders, and transfer fees covered on round ups |

|

$10 |

Transaction fees covered up to $1,000 AUD of buy and sell orders, and $3,000 AUD of auto-invest orders, and transfer fees covered on round ups |

|

$20 |

Transaction fees covered up to $3,000 AUD of buy and sell orders, and $8,000 AUD of auto-invest orders, and transfer fees covered on round ups. Customers can also access the NZX market depth service |

Blossom

Launched in 2021, Blossom exists as an investment fund providing Australians with a simple way to invest in ‘fixed income’ assets. Blossom invests in things like corporate bonds, government bonds, foreign exchange and derivatives, asset backed securities, mortgage backed securities, and more. Traditionally, these types of investments have been reserved for hedge funds, financial institutions, superannuation funds, and high net-worth individuals.

Existing in the digital world, Blossom’s app provides everyday Aussies with exposure to the world of micro-investing, with no minimum investment required. Users can sign up via the Blossom app, or through the Blossom website. From there, users link their bank account, deposit funds and then Blossom does the work for them.

Blossom charges no establishment, withdrawal, performance, or exit fees. Investors utilising Blossom will be charged a 1% p.a. management fee. This fee is only charged once customers have been paid an investment return of at least 5.70% p.a. Any money made on top of this is typically reinvested into the fund.

Pearler

Pearler is an investment platform designed to encourage Aussies to play the long game rather than focus on short-term market speculation. Pearler users can invest in a number of different markets including ASX and US markets as well as ETFs.

For those more familiar with platforms above such as Raiz or Spaceship, Pearler has introduced ‘Micro’ allowing Aussies to invest in solely ETFs under the categories of:

-

Aussie + Global

-

Diversify and Chill

-

Global Large Companies

-

Aussie Large ESG Companies

-

Battery Tech

-

Global Large ESG Companies

-

American Buffet

-

Better Future

Pearler charges a flat-rate brokerage fee of $6.50 for buying and selling shares using the platform. If Pearler users hold some ETFs for a year or more, this brokerage fee is waived. Pearler will also charge a 0.5% AUD flat fee where conversions are required between AUD and USD.

Those taking advantage of Pearler ‘Micro’ will be charged $1.70 per month to hold one fund and $2.30 per month to hold multiple funds. There are no fees to open an account with Pearler, and no maintenance, inactivity or transfer fees.

Stake

Stake offers the ability for investors to take advantage of both Australian and US share markets including some of the most influential global brands including Apple, Amazon, Nike and Google for $0 brokerage.

Stake charges the lowest fee in Australia for CHESS-sponsored ASX trades, at just $3 for trades up to $30,000. To trade US shares, customers are charged a $3USD brokerage fee up to $30,000. For both, if the trade exceeds $30k, the brokerage fee is 0.01% of the trade amount.

Stake allows users to trade on the ASX with CHESS sponsorship and you will have your own Holder Identification Number (HIN). As Stake offers a CHESS-sponsored model, shares are held on your own HIN and only whole shares are supported.

The initial purchase of shares in any listed ASX company or ETF must be at least $500. This is the ASX ‘minimum marketable parcel’ rule. However after that initial $500 purchase, there is no minimum on subsequent purchases of shares in the same company.

In order to utilise Stake, investors are required to convert Australian dollars to US dollars. Investors will need to transfer any US dollars into their Stake account, or convert Aussie dollars into US dollars before making a US trade. Stake currently has a 0.7% fee to convert other currencies into US dollars, with a minimum conversion fee of USD $2.

Douugh

Douugh is a new investment platform with a mission statement of helping Aussies manage and grow their money to live financially better lives, establishing healthy investment routines.

Douugh’s industry-first ‘Autopilot' feature means Aussies can schedule regular investments straight from their connected bank account to create automated investments aligned with their financial goals and budget, removing the emotional and stressful aspects of investing. You can get started investing on Douugh with just $1.

Douugh users can choose from several different portfolio options to diversify their wealth

-

Base (Everest): The Everest portfolio allows you to invest in the top US 100 listed ETFs, rebalanced each quarter.

-

Core: The Core portfolios are all managed by BlackRock, and give you access to a “huge range of world changing companies you know and love”. There are three options, graded by risk:

-

Steady (Low risk)

-

Lift (Moderate risk)

-

Growth (Aggressive risk)

-

-

Sustainable: Also managed by Blackrock, the sustainable portfolios are similar to the core ones in that investments are in a variety of large global companies, but with a focus on sustainability. Again, they are graded by risk:

-

Eco (Conservative)

-

Renew (Moderate)

-

Thrive (Aggresive)

-

Douugh charges $2.99 each month for portfolios over $50. There is another monthly fee $4.99 for unlimited trading share trading. Fees are charged every 28 days based on whether your portfolio is over $50 or you make one or more trades.

There’s a couple of other unique features on offer at Douugh. Firstly, ‘Spot’ allows certain users to borrow up to $500 to invest and repay in instalments, with a fixed $1.99 fee for each repayment. To be eligible for Spot, you need to earn more than $300 per week after tax (Centrelink cannot make up more than 50% of this), receive regular income and pass a financial assessment on your income and spending behaviour.

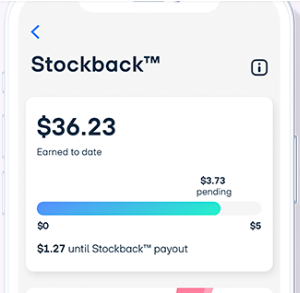

Secondly, ‘Stockback’ is a reward program, offering cash back incentives as you invest. Using Spot and making all your repayments on time for example qualifies you for a 4% Stockback.

Micro-investing platforms compared

The table below compares each of these Australian micro-investing platforms on the fees charged, minimum investment requirements, and the types of investment options allowed.

|

Platform |

Fees |

Minimum investment |

Investment options |

|---|---|---|---|

|

Raiz Invest |

Brokerage: $0 Account fees: Depends on which portfolio you choose. Maximum monthly fee of $5.50 and a 0.275% annual charge for balances over $25,000. |

$5 |

Choose from diversified portfolios with varying risk:

|

|

Spaceship Voyager |

Brokerage: $0 Account fees: $2 per month plus annual management fees of up to 0.50% per year depending on your portfolio |

$0 |

Choose from three portfolios:

|

|

CommSec Pocket |

Brokerage: $2 per trade for investments under $1,000; or 0.2% of trade value for amounts over $1,000 Account fees: $0 |

$50 |

Invest directly into ten different ETFs:

|

|

Sharesies |

Brokerage: 1.9% per trade (capped at $5USD for US shares, $6AUD for Aussie shares and $25NZD for NZ shares) Account fees: Can pay a $5, $10 or $20 monthly subscription which covers brokerage fees to a certain amount |

$0 |

Invest directly in individual companies around the world as well as ETFs from the following markets:

|

|

Blossom |

Brokerage: $0 Account fees: 1% p.a. management fee based on principal amount invested, only paid after 5.25%p.a annual returns |

$5 |

Fixed income fund with a portfolio of:

|

|

Pearler |

Brokerage: $6.50 transaction fee to buy or sell Aussie shares plus 0.5% conversion fee between AUD and USD Account fees: $1.70 per month to invest in one fund, $2.30 per month to invest in multiple. 0.5% conversion fee for shares from AUD to USD also applies. |

$0 |

Invest in either Australian or US shares or ETFs under the following categories:

|

|

Stake |

Brokerage: Up to $30,000 on the ASX-$3AUD per trade, on US markets, $3USD per trade. Trades over $30,000 charged 0.01% for both. Account fees: 0.7% conversion fee for AUD to USD, with a minimum conversion fee of USD $2. |

$500 |

Invest directly in:

|

|

Douugh |

Brokerage: $4.99 for unlimited share trading per 28 days. Account fees: $2.99 for portfolios over $50 per 28 days. |

$1 |

Choose from diversified portfolios including:

|

Benefits of micro-investing platforms

Easy and accessible for beginners

Arguably the biggest benefit of micro-investing platforms is that they make investing in the share market easy and accessible for complete novices. This is because when it comes to investing, many people have a lack of knowledge and/or a lack of funds working against them. Micro-investing apps address these barriers to entry. Unlike traditional investing where you need anywhere between $500-$5,000 to get started, you can start investing in the share market with your spare change through micro-investing apps.

Some micro-investing apps like Raiz have a roundup feature that allows you to drip feed your spare cash into the share market with virtually no effort at all on your part. It’s not hard to see why micro-investing apps have become so popular among younger generations with features such as these.

Choose from a range of diversified portfolios

Another major benefit micro-investing apps have going for them is that you can easily invest in a range of diversified portfolios without needing to have any knowledge about which stocks are best to invest in (although you should still check!).

You could get better returns than using a savings account

Micro-investing apps are based on the principle that regular investing, even in tiny amounts, can lead to generous returns over time. Generally speaking, micro-investing is a long-term investment strategy as opposed to a quick money hit, meaning you could stand to earn a better return on your savings if you keep them in your micro-investing account instead of the bank.

It’s important to remember bank accounts like savings accounts or term deposits are a different product to micro-investing apps. Deposits are generally risk-free and the government guarantee protects up to $250,000 of your money per bank. With no government guarantee, micro-investing comes with much higher risk, meaning there’s a higher chance of losing some or all of your money.

Downsides of micro-investing platforms

Fees could eat into your returns

Depending on how low your account balance is, fees could eat into your returns if you’re not investing enough money regularly. For example, Raiz charges a $4.50 monthly account maintenance fee for balances below $20,000. This monthly fee could really make a difference for investors with smaller balances, which is why it’s important to compare micro-investing apps to find one with a fee structure that will work for your investing goals.

Don’t expect enormous returns

Micro-investing apps are designed as a gateway into the world of investing for beginners and while it’s definitely a great way for newbie investors to dip their toes in, don’t expect to see massive returns, particularly if you’re not investing regularly.

Which micro-investing platform is the best?

As with any financial product, there is no ‘best’ micro-investing platform. Raiz and CommSec pocket may be the most well-known but that doesn’t necessarily mean they’re going to be the right platform for you. What makes a product right for you is how well it suits your needs.

There are a few points of difference between these micro-investing platforms, such as:

-

Some charge brokerage fees, others don’t.

-

Some charge fees, others don’t charge fees at all or only charge fees on balances over a certain amount.

-

Some have a minimum investment amount, while others have a $0 minimum investment.

-

Some allow you to choose a diversified portfolio based on different degrees of risk, others allow you to choose a portfolio made up of certain ETFs (like the top 200 Australian companies on the ASX) and others let you invest in individual companies.

When deciding which one to use, it’s important to consider each of these so you can find the micro-investing tool that best suits your needs and investing goals.

Savings.com.au’s two cents

Like any other investment option, micro-investing carries some element of risk and there’s no guarantee that your investment portfolio will perform as you’re hoping. If you want to start investing though, micro-investing platforms can be a good place for beginners to get their feet wet with fairly low risk.

Many micro-investing platforms allow you to choose an investment portfolio based on your appetite for risk (or lack thereof), so you can choose a more conservative portfolio if you want to minimise the dangers. Keep in mind this could also mean you may not see the same returns as someone who chooses a more aggressive portfolio, but this usually means a riskier investment strategy.

It’s also important to remember the old idiom: investing is all about time in the market, not timing the market. The earlier you begin investing and the longer you invest, the more time you have to ride out the share market dips. Try not to panic if the share market fluctuates.

Investing doesn’t need to be scary, and it’s never too early to start. In fact, not investing early is perhaps the biggest investment mistake of all! Before you take out any financial product, always read the product disclosure statement (PDS) for each investment product and make sure you understand the key fees, features, commissions, risks and benefits.

Image by Tim Samuel via Pexels

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy